OfficeMax 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

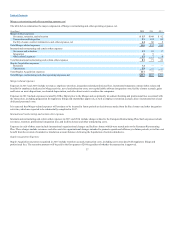

Vendor arrangements — Inventory purchases from vendors are generally under arrangements that automatically renew until cancelled with periodic updates

or annual negotiated agreements. Many of these arrangements require the vendors to make payments to us or provide credits to be used against purchases if

and when certain conditions are met. We refer to these arrangements as “vendor programs.” Vendor programs fall into two broad categories, with some

underlying sub-categories. The first category is volume-based rebates. Under those arrangements, our product costs per unit decline as higher volumes of

purchases are reached. Current accounting rules provide that companies with a reasonable basis for estimating their full year purchases, and therefore the

ultimate rebate level, can use that estimate to value inventory and cost of goods sold throughout the year. We believe our history of purchases with many

vendors provides us with a basis for our estimates of purchase volume. If the anticipated volume of purchases is not reached, however, or if we form the belief

at any point in the year that it is not likely to be reached, cost of goods sold and the remaining inventory balances are adjusted to reflect that change in our

outlook. We review sales projections and related purchases against vendor program estimates at least quarterly and adjust these balances accordingly.

The second broad category of arrangements with our vendors is event-based programs. These arrangements can take many forms, including advertising

support, special pricing offered by certain of our vendors for a limited time, payments for special placement or promotion of a product, reimbursement of costs

incurred to launch a vendor’s product, and various other special programs. These payments are classified as a reduction of costs of goods sold or inventory,

based on the nature of the program and the sell-through of the inventory. Some arrangements may meet the specific, incremental, identifiable cost criteria that

allow for direct operating expense offset, but such arrangements are not significant.

Vendor programs are recognized throughout the year based on judgment and estimates and amounts due from vendors are generally settled throughout the

year based on purchase volumes. The final amounts due from vendors are generally known soon after year-end. Substantially all vendor program receivables

outstanding at the end of the year are settled within the three months following year-end. We believe that our historical collection rates of these receivables

provide a sound basis for our estimates of anticipated vendor payments throughout the year.

Inventory valuation — Inventories are valued at the lower of weighted average cost or market value. We monitor active inventory for excessive quantities

and slow-moving items and record adjustments as necessary to lower the value if the anticipated realizable amount is below cost. We also identify

merchandise that we plan to discontinue or have begun to phase out and assess the estimated recoverability of the carrying value. This includes consideration

of the quantity of the merchandise, the rate of sale, and our assessment of current and projected market conditions and anticipated vendor programs. If

necessary, we record a charge to cost of sales to reduce the carrying value of this merchandise to our estimate of the lower of cost or realizable amount.

Additional promotional activities may be initiated and markdowns may be taken as considered appropriate until the product is sold or otherwise disposed.

Estimates and judgments are required in determining what items to stock and at what level, and what items to discontinue and how to value them prior to

sale.

We also recognize an expense in cost of sales for our estimate of physical inventory loss from theft, short shipments and other factors — referred to as

inventory shrink. During the year, we adjust the estimate of our inventory shrink rate accrual following on-hand adjustments and our physical inventory

count results. These changes in estimates may result in volatility within the year or impact comparisons to other periods.

Long-lived asset impairments — Long-lived assets with identifiable cash flows are reviewed for possible impairment whenever events or changes in

circumstances indicate that the carrying amount of such assets may not be recoverable. We access recovery of the asset or asset groups using estimates of cash

flows directly associated with the future use and eventual disposition of the asset or asset groups. If undiscounted cash flows are insufficient to recover the

asset, an impairment is measured as the difference between the asset’s estimated fair value (generally, the discounted cash flows or its salvage value) and its

carrying value, and any costs of disposition. Factors that could trigger an impairment assessment include, among others, a significant change in the extent or

manner in which an asset is used or the business climate that could affect the value of the asset. As integration activities continue, the Company may identify

assets or asset groups for sale or abandonment and incur impairment charges.

45