OfficeMax 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Refer to Note 2, “Merger, Acquisitions and Dispositions” and Note 3, “Merger, Restructuring, and Other Accruals”, in Notes to the Consolidated Financial

Statements for additional information.

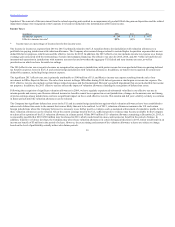

In June 2014, the Company participated in a non-binding, voluntary mediation in which the Company negotiated a potential settlement to resolve the

Sherwin lawsuit. During 2014, the Company recorded an $81 million legal accrual which included the potential settlement, as well as attorneys’ fees and

other related legal matters. On December 19, 2014, Office Depot and the plaintiffs executed a Settlement Agreement to resolve the lawsuit. Pursuant to the

terms of the Settlement Agreement, the Company agreed to pay the plaintiffs $68 million to settle the matter (the “Settlement Amount”), as well as $9 million

in legal fees, costs, and expenses. In exchange for, and in consideration of, the Company’s agreement to pay the Settlement Amount, the plaintiffs agreed to

dismiss their action against the Company with prejudice. In February 2015, the court entered orders approving the settlement and dismissing the case with

prejudice. The Settlement Amount and the related fees were paid during the second quarter of 2015.

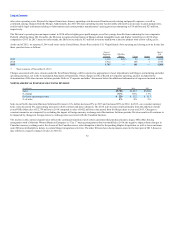

The Company allocates to the Divisions functional support costs that are considered to be directly or closely related to segment activity. Those allocated

costs are included in the measurement of Division operating income. Other companies may charge more or less of functional support costs to their segments,

and our results therefore may not be comparable to similarly titled measures used by other companies. The unallocated costs primarily consist of the

buildings used for the Company’s corporate headquarters and personnel not directly supporting the Divisions, including certain executive, finance, audit and

similar functions. Following the Merger, unallocated costs also include certain pension expense or credit related to the frozen OfficeMax pension and other

benefit plans.

Unallocated costs were $99 million, $122 million, and $89 million in 2015, 2014, and 2013, respectively. The 2015 decrease results primarily from synergies

from the Merger, including the integration of the corporate headquarters. The 2014 increase is primarily due to the addition of a full year of OfficeMax

expenses and higher variable pay.

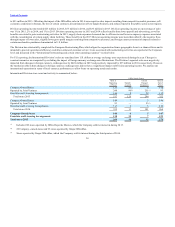

(In millions) 2014 2013

Interest income $ 24 $ 5

Interest expense (89) (69)

Gain on disposition of joint venture — 382

Other income, net — 14

Interest income includes $21 million in 2015 and 2014 and $3 million in 2013, related to OfficeMax Timber Notes, including amortization of the fair value

adjustment recorded in purchase accounting. Interest expense includes non-recourse debt interest, including amortization of the fair value adjustment

recorded in purchase accounting, amounting to $19 million in 2015 and $20 million in 2014, compared to $3 million in 2013. Refer to Note 7, “Timber

Notes/Non-Recourse Debt”, in Notes to Consolidated Financial Statements for additional information. Interest expense in 2014 also includes a $9 million

reversal of previously accrued interest expense on uncertain tax positions following resolution of the related matter.

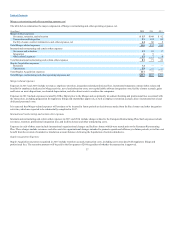

The pre-tax Gain on disposition of joint venture of $382 million results from the July 2013 sale of the investment in Office Depot de Mexico for the Mexican

Peso amount of 8,777 million in cash ($680 million at then-current exchange rates). The gain is net of third party fees, as well as recognition of $39 million of

cumulative translation loss released from other comprehensive income because the subsidiary holding the investment was substantially

38