OfficeMax 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

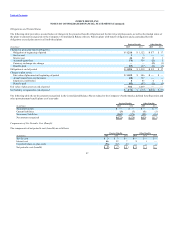

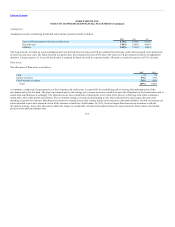

The following is a reconciliation of the change in fair value of the pension plan assets calculated based on Level 3 inputs; during 2014, there was no change

in the fair value of the pension plan assets or transfers of assets valued based on Level 3 inputs.

(In millions)

Balance at December 27, 2014 $ 7

Actual return on plan assets 1

Cash Flows

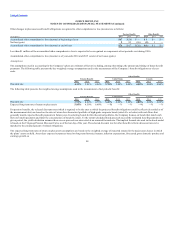

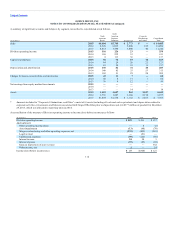

Anticipated benefit payments for the European pension plan, at 2015 year-end exchange rates, are as follows:

(In millions)

2016

2017

2018

2019

2020

Next five years

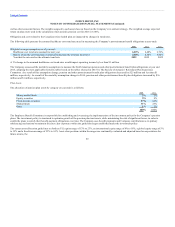

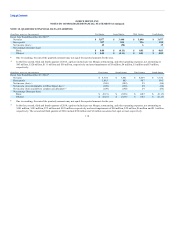

The Company also sponsors defined contribution plans for most of its employees. Eligible Company employees may participate in the Office Depot, Inc.

Retirement Savings Plans (a plan for U.S. employees and a plan for Puerto Rico employees). In December 2014, the Company merged the two contributory

defined contribution savings plans that OfficeMax had in place for most of its salaried and hourly employees (also a plan for U.S. employees and a plan for

Puerto Rico employees) with the respective Office Depot, Inc. Retirement Savings Plan. All of the Company’s defined contribution plans (the “401(k) Plans”)

allow eligible employees to contribute a percentage of their salary, commissions and bonuses in accordance with plan limitations and provisions of Section

401(k) of the Internal Revenue Code and the Company makes partial matching contributions to each plan subject to the limits of the respective 401(k) Plans.

Matching contributions are invested in the same manner as the participants’ pre-tax contributions. The 401(k) Plans also allow for a discretionary matching

contribution in addition to the normal match contributions if approved by the Board of Directors.

Office Depot and OfficeMax previously sponsored non-qualified deferred compensation plans that allowed certain employees, who were limited in the

amount they could contribute to their respective 401(k) plans, to defer a portion of their earnings and receive a Company matching amount. Both plans are

closed to new contributions.

During 2015, 2014, and 2013, $20 million, $16 million, and $9 million, respectively, were recorded as compensation expense for the Company’s

contributions to these programs and certain international retirement savings plans. Additionally, nonparticipating annuity premiums were paid for benefits in

certain European countries totaling $3 million, $4 million, and $4 million in 2015, 2014, and 2013, respectively.

105