OfficeMax 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

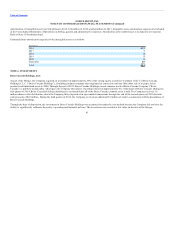

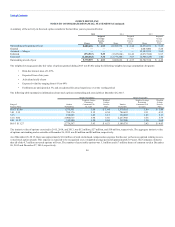

The components of income (loss) before income taxes consisted of the following:

(In millions) 2014 2013

United States $(264) $(230)

Foreign (76) 357

Total income (loss) before income taxes $(340) $ 127

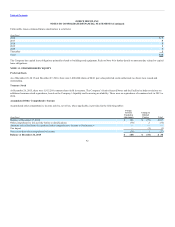

The income tax expense related to income (loss) from operations consisted of the following:

(In millions) 2014 2013

Current:

Federal $ (2) $ 15

State (1) 5

Foreign 15 125

Deferred :

Federal — (4)

State 3 (1)

Foreign (3) 7

Total income tax expense $12 $147

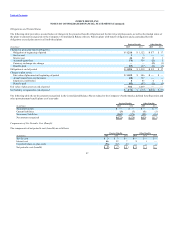

The following is a reconciliation of income taxes at the U.S. Federal statutory rate to the provision for income taxes:

(In millions) 2014 2013

Federal tax computed at the statutory rate $(119) $ 44

State taxes, net of Federal benefit 4 3

Foreign income taxed at rates other than Federal (10) (28)

Increase (decrease) in valuation allowance 112 8

Non-deductible goodwill impairment — 15

Non-deductible Merger expenses — 13

Non-deductible foreign interest 13 8

Other non-deductible expenses 12 4

Non-taxable income and additional deductible expenses — —

Change in unrecognized tax benefits (2) —

Tax expense from intercompany transactions 2 2

Subpart F and dividend income, net of foreign tax credits 2 75

Change in tax rate — 2

Deferred taxes on undistributed foreign earnings — 5

Other items, net (2) (4)

Income tax expense $ 12 $147

The increase in income tax expense from 2014 to 2015 is primarily related to the transition of the U.S. business from a loss jurisdiction with valuation

allowance to a profitable tax-paying jurisdiction with valuation allowance. The Company also incurred charges related to certain Staples Acquisition

expenses that are not deductible for tax purposes, which increased the effective tax rate for 2015. In addition, the 2015 effective tax rate includes U.S. income

tax expense on a foreign exchange gain associated with the restructuring of certain intercompany financing. In 2014, the Company recognized income tax

expense on a pretax loss due to deferred tax benefits not being recognized on pretax losses in certain tax jurisdictions with valuation allowances, while

income tax expense was

87