OfficeMax 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

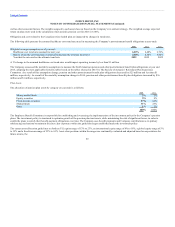

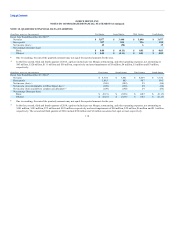

Following identification of retail stores for closure as part of the Real Estate Strategy, the related favorable lease assets were assessed for accelerated

amortization or impairment. Considerations included the Level 3 projected cash flows discussed above, the net book value of operating assets and favorable

lease assets, and likely sublease over the option period after closure or return of property to landlords. Impairments of $1 million and $5 million were

recognized during 2015 and 2014, respectively.

Indefinite-lived intangible assets — During 2014, the Company reassessed its use of a private brand trade name used internationally, that previously had

been assigned an indefinite life. The expected change in profile and life of this brand, along with assigning an estimated life of three years, resulted in an

impairment charge of $5 million. This charge is not included in determination of Division operating income. The estimated fair value was calculated based

on a discounted relief from royalty method using Level 3 inputs.

Goodwill associated with the Merger has been allocated to the reporting units for the purposes of the annual goodwill impairment test. The estimated fair

values of the reporting units at the 2015 test date were substantially in excess of their carrying values.

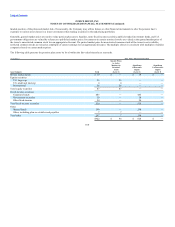

As of December 29, 2012, goodwill of $45 million was included in the International Division in a reporting unit comprised of wholly-owned operating

subsidiaries in Europe and ownership of the joint venture operating in Mexico. The total estimated fair value of the reporting unit exceeded its carrying value

by approximately 30%, however, a substantial majority of that excess value was associated with the joint venture. In 2013, when the reporting unit sold its

investment in the joint venture and distributed essentially all of the after tax proceeds to its U.S. parent, the fair value fell below its carrying value. Because

the investment was accounted for under the equity method, no goodwill was allocated to the gain on disposition of joint venture calculation. However,

concurrent with the sale and gain recognition, a goodwill impairment charge of $44 million was recognized.

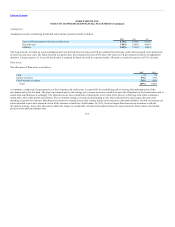

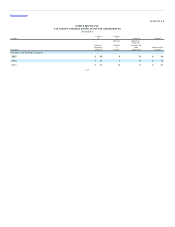

On June 25, 2011, OfficeMax, with which the Company merged in November 2013, entered into a paper supply contract with Boise White Paper, L.L.C.

(“Boise Paper”), under which OfficeMax agreed to purchase office papers from Boise Paper, and Boise Paper has agreed to supply office paper to OfficeMax,

subject to the terms and conditions of the paper supply contract. The paper supply contract replaced the previous supply contract executed in 2004 with

Boise Paper. The Company assumed the commitment under a paper supply contract to buy OfficeMax’s North American requirements for office paper, subject

to certain conditions, including conditions under which the Company may purchase paper from paper producers other than Boise Paper. The paper supply

contract’s term will expire on December 31, 2017, followed by a gradual reduction of the Company’s purchase requirements over a two year period thereafter.

However, if certain circumstances occur, the agreement may be terminated earlier. If terminated, it will be followed by a gradual reduction of the Company’s

purchase requirements over a two year period. Purchases under the agreement were $612 million in 2015, $647 million in 2014, and $87 million in the period

from Merger date through year-end 2013.

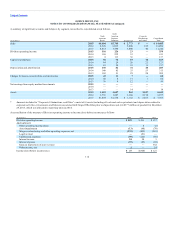

Indemnification obligations may arise from the Asset Purchase Agreement between OfficeMax Incorporated, OfficeMax Southern Company, Minidoka Paper

Company, Forest Products Holdings, L.L.C. and Boise Land & Timber Corp. The Company has agreed to provide indemnification with respect to a variety of

obligations. These indemnification obligations are subject, in some cases, to survival periods, deductibles and caps. At December 26, 2015, the Company is

not aware of any material liabilities arising from these indemnifications.

109