OfficeMax 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

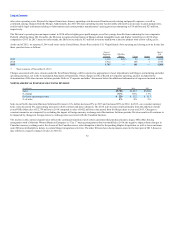

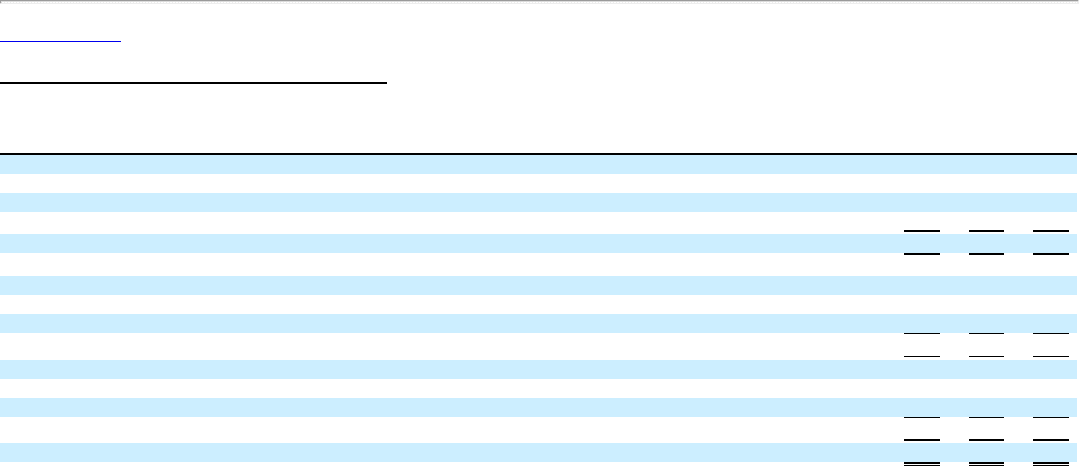

Merger, restructuring and other operating expenses, net

The table below summarizes the major components of Merger, restructuring and other operating expenses, net.

(In millions) 2014 2013

Merger related expenses

Severance, retention, and relocation $148 $ 92

Transaction and integration 124 80

Facility closure, contract termination, and other expenses, net 60 8

Total Merger related expenses 332 180

International restructuring and certain other expenses

Severance and retention 55 17

Integration 9 —

Other related expenses 7 4

Total International restructuring and certain other expenses 71 21

Staples Acquisition expenses

Retention — —

Transaction — —

Total Staples Acquisition expenses — —

Total Merger, restructuring and other operating expenses, net $403 $201

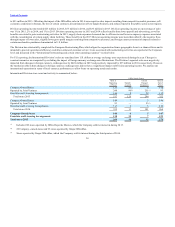

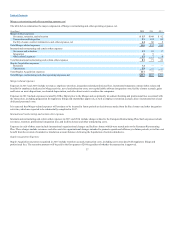

Merger-related expenses

Expenses in 2015 and 2014 include severance, employee retention, integration-related professional fees, incremental temporary contract labor, salary and

benefits for employees dedicated to Merger activity, travel and relocation costs, non-capitalizable software integration costs, facility closure accruals, gains

and losses on asset dispositions, accelerated depreciation, and other direct costs to combine the companies.

Expenses in 2013 include expenses incurred by Office Depot prior to the Merger and are primarily investment banking and professional fees associated with

the transaction, including preparation for regulatory filings and shareholder approvals, as well as employee retention accruals, direct incremental travel and

dedicated personnel costs.

It is expected that Merger-related expenses will continue to be incurred in future periods as decisions are made about facility closures and other integration

activities, which are expected to be substantially completed in 2017.

International restructuring and certain other expenses

International restructuring and certain other expenses in 2015 and 2014 include charges related to the European Restructuring Plan. Such expenses include

severance, retention, professional integration fees, and facility closure and other restructuring costs.

Expenses in each of three years include international organizational changes and facility closures which were started prior to the European Restructuring

Plan. These charges include severance and other costs for organizational changes intended to promote operational efficiency in future periods, as well as a net

benefit from the reversal of cumulative translation account balances following the liquidation of certain subsidiaries.

Staples Acquisition Expenses

Staples Acquisition expenses recognized in 2015 include retention accruals, transaction costs, including costs associated with regulatory filings and

professional fees. The retention amounts will be paid in the first quarter of 2016 regardless of whether the transaction is approved.

37