OfficeMax 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

required to pay Office Depot a termination fee of $250 million if the Staples Merger Agreement is terminated in certain circumstances relating to the antitrust

regulatory review process. On February 2, 2016, the Company and Staples entered into a letter agreement to waive, until May 16, 2016, certain of their

respective rights to terminate the Staples Merger Agreement.

In addition, whether or not the Staples Acquisition is completed, the uncertainty related to the proposed Staples Acquisition could continue to adversely

impact our business through several factors, including, but not limited to: (i) our current customers may experience uncertainty associated with the Staples

Acquisition and may attempt to negotiate changes in existing business relationships or consider entering into business relationships with parties other than

us; (ii) we may face additional challenges in competing for new and renewal business; (iii) vendors or suppliers may seek to modify or terminate their

business relationships with us; and (iv) our ability to retain and hire associates.

In 2016, the Company expects to incur $30 million of additional expenses related to the extended regulator reviews of the pending acquisition by Staples.

The $72 million accrued retention will be paid in the first quarter of 2016, regardless of review decisions.

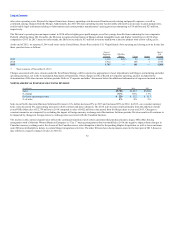

Cash Flows

Cash provided by (used in) operating, investing and financing activities is summarized as follows:

(In millions) 2014 2013

Operating activities $156 $ (107)

Investing activities (28) 1,028

Financing activities 15 (640)

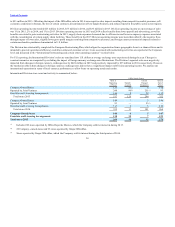

Operating Activities

The 2015 and 2014 operating cash flows reflect a full year of operations as a combined company compared to the 2013 impact of the OfficeMax business

only following the Merger date of November 5, 2013. Operating activities reflect outflows related to Merger and integration activities in all three years. Cash

used in operating activities in 2013 was negatively impacted by the payment of $147 million of income taxes related to the Company’s gain on the

disposition of the investment in Office Depot de Mexico. The source of cash from this gain is shown in Investing activities.

Changes in net working capital for 2015 resulted in a $276 million use of cash compared to $10 million in 2014 and $77 million in 2013. The working

capital factors in 2015 includes $77 million settlement payment of the Legal Accrual, the payment of the 2014 accrued incentive pay, and a net use of cash in

integration related activities. Additionally, inventory levels are higher at year-end 2015 when compared to the 2014 period, impacted by the supply chain

integration. The working capital factors in 2014 are largely attributable to timing, including the impact on certain payables of a one day shift in the retail

calendar. The change in accounts receivable in 2013 was influenced by the timing of certain vendor arrangements, largely offset by proceeds from an account

receivable factoring agreement in France. The increase in inventories in 2013 reflects building above prior year levels for the back to business selling cycle.

Inventory balances were lower at the end of 2012 as a result of initiatives to better manage working capital. The working capital changes in 2013 were also

impacted by the timing of the Merger, which caused the consolidated cash flows to reflect the changes in the OfficeMax working capital accounts from the

Merger date through year-end 2013.

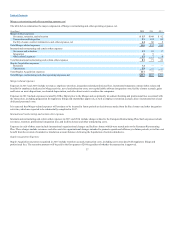

The timing of changes in working capital is subject to variability during the year and across years depending on a variety of factors, including period end

sales, the flow of goods, credit terms, timing of promotions, vendor production planning, new product introductions and working capital management. For

our accounting policy on cash management, refer to Note 1, “Summary of Significant Accounting Policies,” of the Consolidated Financial Statements.

41