OfficeMax 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

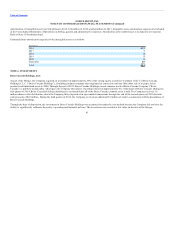

Other assets held for sale

Certain facilities identified for closure through integration and other activities have been accounted for as assets held for sale. Assets held for sale primarily

consist of supply chain facilities and are presented in Prepaid expenses and other current assets in the Consolidated Balance Sheets. The assets held for sale

activity in 2015 is presented in the table below.

(In millions)

Balance as of December 27, 2014 $ 31

Additions 67

Dispositions (57)

Reclassifications and other adjustments (11)

Balance as of December 26, 2015 $ 30

Any gain on these dispositions, which are expected to be completed within one year, will be recognized at the Corporate level and included when realized in

Merger, restructuring and other operating expenses, net in the Consolidated Statements of Operations. Refer to Note 3 for further information on Merger,

restructuring and other operating expenses, net, including gains realized related to disposition of held for sale assets.

The components of goodwill by segment are provided in the following table:

(In millions)

Goodwill $ 2 $ 370 $ 909 $ 377 $ 1,658

Accumulated impairment losses (2) (349) (907) — (1,258)

Foreign currency rate impact — — (2) — (2)

Balance as of December 28, 2013 $ — $ 21 $ — $ 377 $ 398

Purchase accounting adjustments — — — 17 17

Sale of Grupo OfficeMax — — — (24) (24)

Allocation to reporting units 78 277 15 (370) —

Balance as of December 27, 2014 $ 78 $ 298 $ 15 $ — $ 391

Purchase accounting adjustments relate to goodwill associated with a 2015 acquisition, as disclosed in Note 2, as well as final adjustments related to prior

acquisitions.

The allocation of the Merger consideration to the reporting units was completed in the third quarter of 2014. As the Company finalized the purchase price

allocation in 2014, certain preliminary values were adjusted as additional information became available. Initial amounts allocated to certain property and

equipment accounts

79