OfficeMax 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

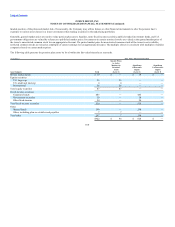

Assumptions

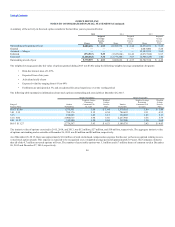

Assumptions used in calculating the funded status and net periodic benefit included:

2014 2013

Expected long-term rate of return on plan assets 5.55% 6.33%

Discount rate 3.80% 4.60%

Inflation 3.10% 3.40%

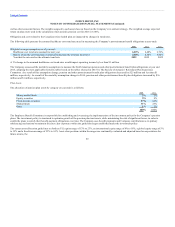

The long-term rate of return on assets assumption has been derived based on long-term UK government fixed income yields, having regard to the proportion

of assets in each asset class. The funds invested in equities have been assumed to return 4.0% above the return on UK government securities of appropriate

duration. A return equal to a 15 year AA bond index is assumed for funds invested in corporate bonds. Allowance is made for expenses of 0.5% of assets.

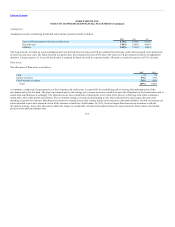

Plan Assets

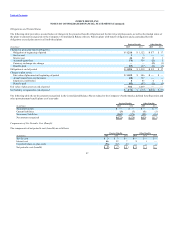

The allocation of Plan assets is as follows:

2014

Cash 1%

Equity securities 53%

Fixed-income securities 46%

Total 100%

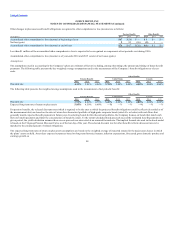

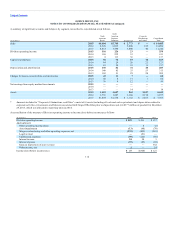

A committee, comprised of representatives of the Company and of this plan, is responsible for establishing and overseeing the implementation of the

investment policy for this plan. The plan’s investment policy and strategy are to ensure assets are available to meet the obligations to the beneficiaries and to

adjust plan contributions accordingly. The plan trustees are also committed to reducing the level of risk in the plan over the long term, while retaining a

return above that of the growth of liabilities. The investment strategy is based on plan funding levels, which determine the asset target allocation into

matching or growth investments. Matching investments are intended to provide a return similar to the increase in the plan liabilities. Growth investments are

assets intended to provide a return in excess of the increase in liabilities. At December 26, 2015, the asset target allocation was in accordance with the

investment strategy. Asset-class allocations within the ranges are continually evaluated and adjusted based on expectations for future returns, the funded

position of the plan and market risks.

103