OfficeMax 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

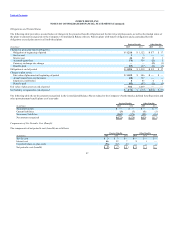

The Company’s total valuation allowance decreased by $41 million during 2015, of which $27 million was attributable to foreign currency translation

adjustments. In addition, the Company recognized income tax expense of $4 million associated with the establishment of valuation allowances in certain

foreign jurisdictions in 2015 because the realizability of the related deferred tax assets was no longer more likely than not. Valuation allowances were

released in certain foreign jurisdictions in 2014 due to the existence of sufficient positive evidence, which resulted in an income tax benefit of $4 million. As

of 2015, valuation allowances remain in the U.S. and certain foreign jurisdictions where the Company believes it is necessary to see further positive evidence,

such as sustained achievement of cumulative profits, before these valuation allowances can be released. Given the current earnings trend in the U.S.,

sufficient positive evidence may become available for the Company to release all or a portion of the U.S. valuation allowance in a future period. Of the $493

million U.S. valuation allowance remaining at December 26, 2015, it is reasonably possible that $265-$360 million may be released in 2016, which would

result in a non-cash income tax benefit in the period of release. In addition, if positive evidence develops, the Company may also release valuation

allowances in certain foreign jurisdictions in 2016, which would result in an income tax benefit of $3 million in the period of release. However, the exact

timing and amount of the valuation allowance releases are subject to change based on the level of profitability actually achieved in future periods. The

Company will continue to assess the realizability of its deferred tax assets in the U.S. and remaining foreign jurisdictions.

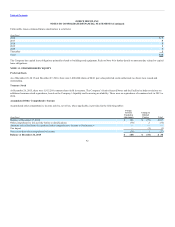

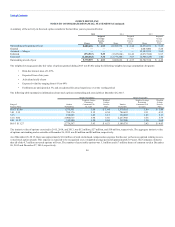

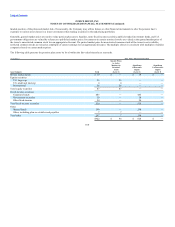

The following table summarizes the activity related to unrecognized tax benefits:

(In millions) 2014 2013

Beginning balance $15 $ 5

Increase related to current year tax positions 7 4

Increase related to prior year tax positions 4 —

Decrease related to prior year tax positions (2) —

Decrease related to lapse of statute of limitations — —

Decrease related to settlements with taxing authorities (1) —

Increase related to the Merger — 6

Ending balance $23 $15

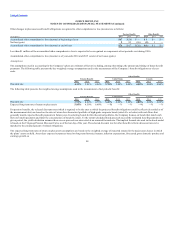

Due to the completion of the Internal Revenue Service (“IRS”) examination for 2013, the Company’s balance of unrecognized tax benefits decreased by $4

million during 2015, which did not impact income tax expense due to an offsetting change in valuation allowance. Included in the balance of $18 million at

December 26, 2015, are $6 million of unrecognized tax benefits that, if recognized, would affect the effective tax rate. The difference of $12 million primarily

results from tax positions which if sustained would be offset by changes in valuation allowance. It is reasonably possible that certain tax positions will be

resolved within the next 12 months, which would decrease the Company’s balance of unrecognized tax benefits by $5 million but would not affect the

effective tax rate due to an offsetting change in valuation allowance. Additionally, the Company anticipates that it is reasonably possible that new issues will

be raised or resolved by tax authorities that may require changes to the balance of unrecognized tax benefits; however, an estimate of such changes cannot

reasonably be made.

The Company recognizes interest related to unrecognized tax benefits in interest expense and penalties in the provision for income taxes. The Company

recognized interest and penalty expense of $2 million and $1 million in 2015 and 2013, respectively. The Company recognized a net interest and penalty

benefit of $9 million in 2014 due to settlements reached with certain taxing authorities. The Company had approximately $3 million accrued for the payment

of interest and penalties as of December 26, 2015, which is not included in the table above.

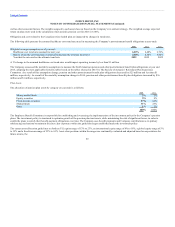

The Company files a U.S. federal income tax return and other income tax returns in various states and foreign jurisdictions. With few exceptions, the

Company is no longer subject to U.S. federal and state and local income tax examinations for years before 2014 and 2009, respectively. During 2015, the IRS

examination of the

90