OfficeMax 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

the Amended Credit Agreement, and certain of their present and future equity interests in foreign subsidiaries. The Senior Secured Notes are secured on a

second-priority basis by a lien on the Company and its domestic subsidiaries’ assets that secure the Amended Credit Agreement. The Senior Secured Notes

were issued pursuant to an indenture, dated as of March 14, 2012, among the Company, the domestic subsidiaries named therein and U.S. Bank National

Association, as trustee (the “Indenture”).

The terms of the Indenture provide that, among other things, the Senior Secured Notes and guarantees will be senior secured obligations and will: (i) rank

senior in right of payment to any future subordinated indebtedness of the Company and the guarantors; (ii) rank equally in right of payment with all of the

existing and future senior indebtedness of the Company and the guarantors; (iii) rank effectively junior to all existing and future indebtedness under the

Amended Credit Agreement to the extent of the value of certain collateral securing the Facility on a first-priority basis, subject to certain exceptions and

permitted liens; (iv) rank effectively senior to all existing and future indebtedness under the Amended Credit Agreement to the extent of the value of certain

collateral securing the Senior Secured Notes; and (v) be structurally subordinated in right of payment to all existing and future indebtedness and other

liabilities of the Company’s non-guarantor subsidiaries (other than indebtedness and liabilities owed to the Company or one of the guarantors).

The Indenture contains affirmative and negative covenants that, among other things, limit or restrict the Company’s ability to: incur additional debt or issue

stock, pay dividends, make certain investments or make other restricted payments; engage in sales of assets; and engage in consolidations, mergers and

acquisitions. However, many of these currently active covenants will cease to apply for so long as the Company receives and maintains investment grade

ratings from specified debt rating services and there is no default under the Indenture. There are no maintenance financial covenants.

The Senior Secured Notes may be redeemed by the Company, in whole or in part, at any time prior to March 15, 2016 at a price equal to 100% of the

principal amount plus a make-whole premium as of the redemption date and accrued and unpaid interest. Thereafter, the Senior Secured Notes carry optional

redemption features whereby the Company has the redemption option prior to maturity at par plus a premium beginning at 104.875% at March 15, 2016 and

declining ratably to par at March 15, 2018 and thereafter, plus accrued and unpaid interest.

Upon the occurrence of a change of control, holders of the Senior Secured Notes may require the Company to repurchase all or a portion of the Senior Secured

Notes in cash at a price equal to 101% of the principal amount to be repurchased plus accrued and unpaid interest to the repurchase date. Change of control,

as defined in the Indenture, is a transfer of all or substantially all of the assets of Office Depot, acquisition of more than 50% of the voting power of Office

Depot by a person or group, or members of the Office Depot Board of Directors as previously approved by the stockholders of Office Depot ceasing to

constitute a majority of the Office Depot Board of Directors.

Under the Staples Merger Agreement, the Senior Secured Notes will be discharged, redeemed or defeased at the Effective Time of the Staples Acquisition.

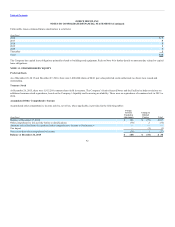

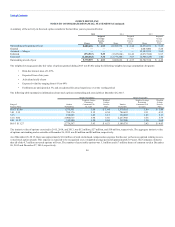

As a result of the Merger, the Company assumed the liability for the amounts in the table above related to the (i) 7.35% debentures, due 2016, which were

paid in full at maturity in February 2016, (ii) Revenue bonds, due in varying amounts periodically through 2029, and (iii) American & Foreign Power

Company, Inc. 5% debentures, due 2030.

85