OfficeMax 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In recent years, the Company has taken actions to adapt to changing and competitive conditions. These actions include closing facilities, consolidating

functional activities, eliminating redundant positions, disposing of businesses and assets, and taking actions to improve process efficiencies. In 2013, the

Merger was completed and integration activities similar to the actions described above began. The Company also assumed certain restructuring liabilities

previously recorded by OfficeMax. In mid-2014, the Company’s Real Estate Strategy identified at least 400 retail stores for closure through 2016 along with

planned changes to the supply chain. In 2014, the Company approved a plan to realign the European organization from a geographic-focus to a business

channel-focus (the “European Restructuring Plan”). In 2015, the Staples Acquisition was announced. Significant expenses have been recognized associated

with these activities, as discussed below.

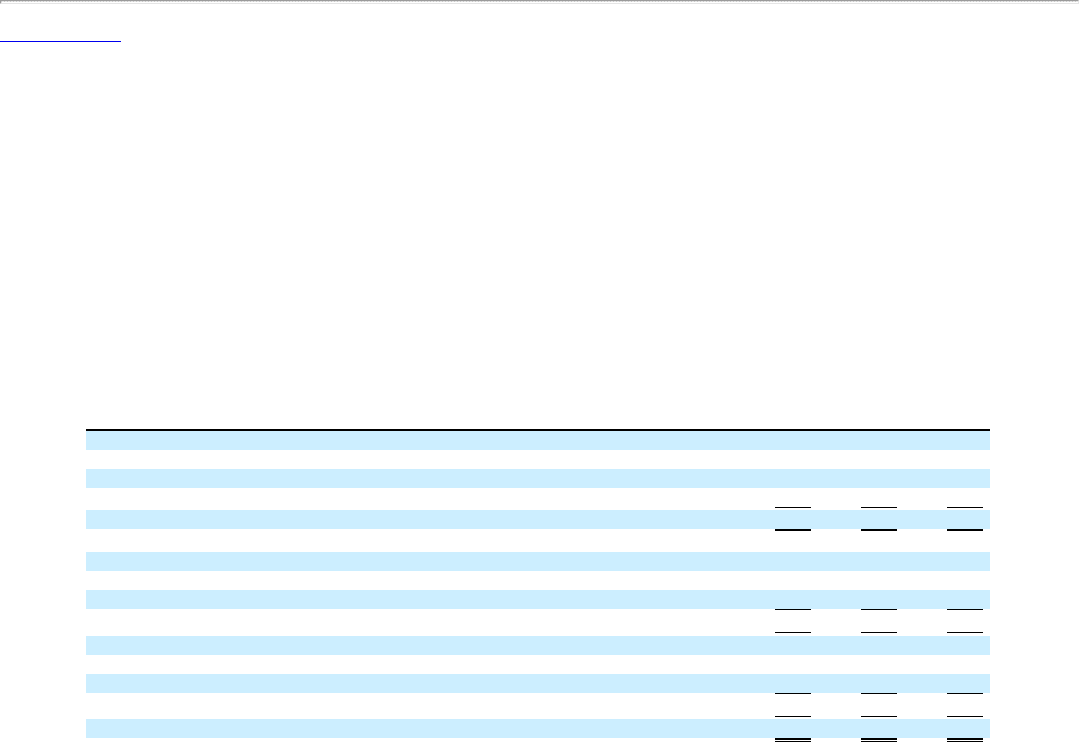

The Company presents Merger, restructuring and other operating expenses, net on a separate line in the Consolidated Statements of Operations to identify

these activities apart from the expenses incurred to sell to and service its customers. These expenses are not included in the determination of Division

operating income. The table below summarizes the major components of Merger, restructuring and other operating expenses, net.

(In millions) 2014 2013

Merger related expenses:

Severance, retention, and relocation $148 $ 92

Transaction and integration 124 80

Facility closure, contract termination, and other expenses, net 60 8

Total Merger related expenses 332 180

International restructuring and certain other expenses:

Severance and retention 55 17

Integration 9 —

Other related expenses 7 4

Total International restructuring and certain other expenses 71 21

Staples Acquisition expenses:

Retention — —

Transaction — —

Total Staples Acquisition expenses — —

Total Merger, restructuring and other operating expenses, net $403 $201

Merger related expenses

Severance, retention, and relocation expenses include amounts incurred by Office Depot in 2013 and by the combined companies since the date of the

Merger, and reflect integration throughout the staff functions. Since the second quarter of 2014, the Real Estate Strategy has been sufficiently developed to

provide a basis for estimating termination benefits for certain retail and supply chain closures that are expected to be substantially complete by the end of

2017. Such benefits are being accrued through the anticipated facility closure dates. Severance calculations consider factors such as the expected timing of

facility closures, terms of existing severance plans, expected employee turnover and attrition.

75