OfficeMax 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

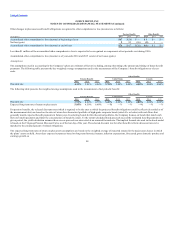

recognized in tax jurisdictions with pretax income. The significant income tax expense in 2013 is primarily attributable to the 2013 sale of the Company’s

investment in Office Depot de Mexico, which is discussed in Note 2. In 2013, the Company paid $117 million of Mexican income tax upon the sale and

recognized additional U.S. income tax expense of $23 million due to dividend income and Subpart F income as a result of the sale, for total income tax

expense of $140 million. The sale of the Company’s interest in Grupo OfficeMax during 2014 did not generate a similar gain or income tax expense. The

2013 effective tax rate also includes charges related to goodwill impairment (refer to Note 15) and certain Merger expenses that are not deductible for tax

purposes.

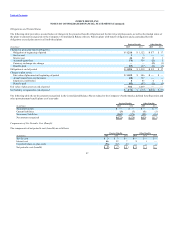

The Company operates in several foreign jurisdictions with income tax rates that differ from the U.S. Federal statutory rate, which resulted in a benefit for all

years presented in the effective tax rate reconciliation. This benefit in 2015 is primarily attributable to earnings in the Netherlands. Significant foreign tax

jurisdictions for which the Company realized such benefit in 2014 and 2013 also included the UK and France. Additionally, Mexico is included for 2013 due

to the sale of Office Depot de Mexico.

Due to valuation allowances against the Company’s deferred tax assets, no income tax benefit was initially recognized in the 2015, 2014, or 2013

Consolidated Statement of Operations related to stock-based compensation expense. However, due to the profitable tax-paying position in the U.S. in 2015

and 2013, the Company realized an income tax benefit of $3 million and $5 million, respectively, for the utilization of net operating loss carryforwards that

had resulted from excess stock-based compensation deductions for which no benefit was previously recorded. The Company also realized an income tax

benefit of $7 million and $3 million for excess stock-based compensation deductions resulting from the exercise and vesting of equity awards during 2015

and 2013, respectively. These income tax benefits were recorded as increases to additional paid-in capital in 2015 and 2013. The income tax benefits

recorded in 2013 were primarily attributable to the sale of Office Depot de Mexico.

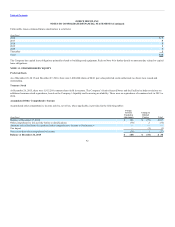

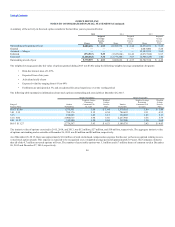

The components of deferred income tax assets and liabilities consisted of the following:

(In millions)

December 27,

2014

U.S. and foreign net operating loss carryforwards $ 322

Deferred rent credit 80

Pension and other accrued compensation 184

Accruals for facility closings 45

Inventory 23

Self-insurance accruals 33

Deferred revenue 39

U.S. and foreign income tax credit carryforwards 246

Allowance for bad debts 5

Accrued expenses 80

Basis difference in fixed assets 59

Other items, net 8

Gross deferred tax assets 1,124

Valuation allowance (804)

Deferred tax assets 320

Internal software 8

Installment gain on sale of timberlands 251

Deferred Subpart F income 27

Undistributed foreign earnings 2

Deferred tax liabilities 288

Net deferred tax assets $ 32

88