OfficeMax 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

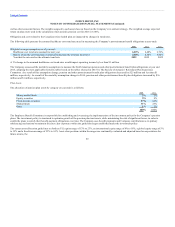

As of December 26, 2015 and December 27, 2014, deferred income tax liabilities amounting to $3 million and $4 million, respectively, are included in

Deferred income taxes and other long-term liabilities.

During the fourth quarter of 2015, the Company early adopted the new accounting standard that requires that all deferred taxes be presented as noncurrent on

the Consolidated Balance Sheets. Refer to Basis of Presentation in Note 1 for further information.

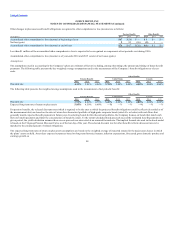

As of December 26, 2015, the Company has utilized all of its U.S. Federal net operating loss (“NOL”) carryforwards. The Company has $903 million of

foreign and $1.5 billion of state NOL carryforwards. Of the foreign NOL carryforwards, $737 million can be carried forward indefinitely, $7 million will

expire in 2016, and the remaining balance will expire between 2017 and 2035. Of the state NOL carryforwards, $48 million will expire in 2016, and the

remaining balance will expire between 2017 and 2035. The Company also has $102 million of U.S. Federal alternative minimum tax credit carryforwards,

which can be used to reduce future regular federal income tax, if any, over an indefinite period. Additionally, the Company has $117 million of U.S. Federal

foreign tax credit carryforwards, which expire between 2016 and 2025, and $17 million of state and foreign tax credit carryforwards, $5 million of which can

be carried forward indefinitely, and the remaining balance will expire between 2023 and 2027.

As of December 26, 2015, the Company has not triggered an “ownership change” as defined in Internal Revenue Code Section 382 or other similar

provisions that would limit the use of NOL and tax credit carryforwards. However, if the Company were to experience an ownership change in future periods,

the Company’s deferred tax assets and income tax expense may be negatively impacted.

U.S. deferred income taxes have not been provided on certain undistributed earnings of foreign subsidiaries, which were approximately $204 million as of

December 26, 2015. The determination of the amount of the related unrecognized deferred tax liabilities is not practicable because of the complexities

associated with the hypothetical calculations. The Company has historically reinvested such earnings overseas in foreign operations and expects that future

earnings will also be indefinitely reinvested overseas, with the exception of certain foreign subsidiaries acquired as a result of the Merger. Accordingly, the

Company has recorded the deferred tax liabilities associated with the undistributed earnings of such foreign subsidiaries.

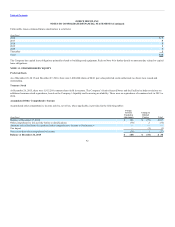

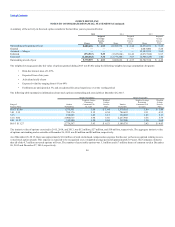

The following summarizes the activity related to valuation allowances for deferred tax assets:

(In millions) 2014 2013

Beginning balance $683 $583

Additions, charged to expense 121 26

Additions, due to the Merger — 84

Reductions — (10)

Ending balance $804 $683

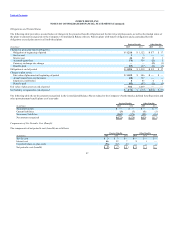

The Company has significant deferred tax assets in the U.S. and in certain foreign jurisdictions against which valuation allowances have been established to

reduce such deferred tax assets to the amount that is more likely than not to be realized. The establishment of valuation allowances requires significant

judgment and is impacted by various estimates. Both positive and negative evidence, as well as the objectivity and verifiability of that evidence, is

considered in determining the appropriateness of recording a valuation allowance on deferred tax assets. An accumulation of recent pre-tax losses is

considered strong negative evidence in that evaluation. While the Company believes positive evidence exists with regard to the realizability of the deferred

tax assets in these jurisdictions, it is not considered sufficient to outweigh the objectively verifiable negative evidence, including the cumulative 36-month

pre-tax loss history, as of December 26, 2015.

89