OfficeMax 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

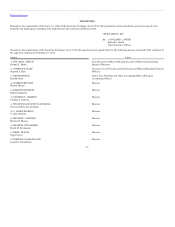

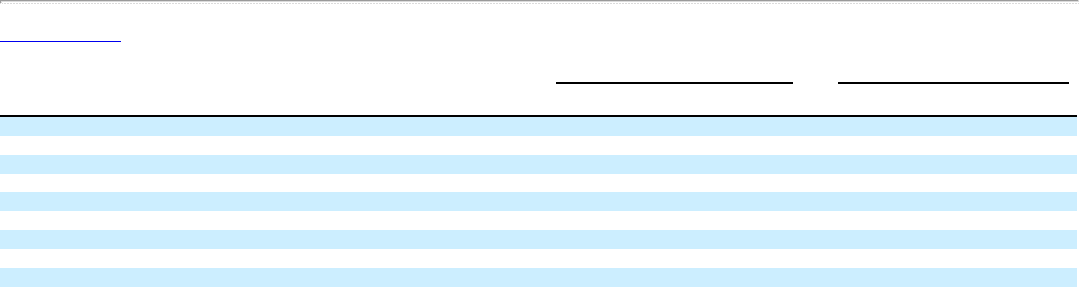

2014

(In millions)

Carrying

Value

Fair

Value

Risk

Sensitivity

Financial assets:

Timber notes receivable $ 926 $ 930 $ 21

Financial liabilities:

Recourse debt:

Senior Secured Notes, due 2019 $ 250 $ 280 $ 2

7.35% debentures, due 2016 $ 18 $ 18 $ —

Revenue bonds, due in varying amounts periodically through 2029 $ 186 $ 185 $ 7

American & Foreign Power Company, Inc. 5% debentures, due 2030 $ 14 $ 13 $ 1

Non-recourse debt $ 839 $ 845 $ 18

The risk sensitivity of fixed rate debt reflects the estimated increase in fair value from a 50 basis point decrease in interest rates, calculated on a discounted

cash flow basis. The sensitivity of variable rate debt reflects the possible increase in interest expense during the next period from a 50 basis point change in

interest rates prevailing at year-end.

Foreign Exchange Rate Risk

We conduct business through entities in various countries outside the United States where their functional currency is not the U.S. dollar. Our principal

international operations are in countries with Euro, British Pound, Canadian Dollar, Australian Dollar, and New Zealand Dollar functional currencies. We

continue to assess our exposure to foreign currency fluctuation against the U.S. dollar. As of December 26, 2015, a 10% change in the applicable foreign

exchange rates would result in an increase or decrease in our pretax earnings of $7 million.

Although operations generally are conducted in the relevant local currency, we also are subject to foreign exchange transaction exposure when our

subsidiaries transact business in a currency other than their own functional currency. This exposure arises primarily from inventory purchases denominated in

a foreign currency. At December 26, 2015, there are foreign exchange forward contracts with an aggregate notional amount of $29 million hedging inventory

exposures. Also, from time-to-time, we enter into foreign exchange forward transactions to protect against possible changes in exchange rates related to

scheduled or anticipated cash movements among our operating entities. At December 26, 2015, foreign exchange forward contracts with an aggregate

notional amount of $64 million were in place to hedge these movements. The highest notional amount outstanding for all the foreign exchange forward

contracts at any point during 2015 was $93 million during the month of December. Derivative contracts are marked to market at each reporting period. Gains

and loss are presented in the same caption as the hedged item or Other income, net, as appropriate. The economic hedging transactions are not considered

material.

Generally, we evaluate the performance of our international businesses by focusing on the results of the business in local currency, and not with regard to the

translation into U.S. dollars, as the latter is impacted by external factors. However, changes in foreign exchange rates have affected comparison of reported

U.S. dollars Division results. Where applicable, changes in U.S. dollars and constant currencies have been reported in Management’s Discussion and Analysis

of Financial Condition and Results of Operations.

Commodities Risk

We operate a large network of stores and delivery centers around the world. As such, we purchase fuel needed to transport products to our stores and

customers as well as pay shipping costs to import products from overseas. We are exposed to potential changes in the underlying commodity costs associated

with this transport activity.

50