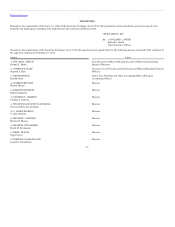

OfficeMax 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The Company also early adopted for 2015 reporting the new accounting standard that allows as a practical expedient, the measurement of pension assets and

liabilities at the calendar year end, rather than the fiscal year end date. There were no changes to prior reported amounts or disclosures from adopting this

standard.

Fiscal years are based on a 52- or 53-week period ending on the last Saturday in December. Certain international locations operate on a calendar

year basis; however, the reporting difference is not considered significant. All years presented in the Consolidated Financial Statements consisted of 52

weeks; fiscal year 2016 will include 53 weeks.

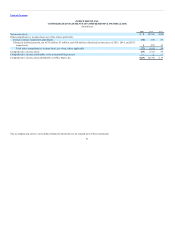

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of

America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual

results could differ from those estimates.

International operations primarily use local currencies as their functional currency. Assets and liabilities are translated into U.S. dollars

using the exchange rate at the balance sheet date. Revenues, expenses and cash flows are translated at average monthly exchange rates, or rates on the date of

the transaction for certain significant items. Translation adjustments resulting from this process are recorded in Stockholders’ equity as a component of

Accumulated other comprehensive income.

Foreign currency transaction gains or losses are recorded in the Consolidated Statements of Operations in Other income (expense), net or Cost of goods sold

and occupancy costs, depending on the nature of the transaction.

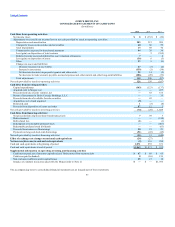

All short-term highly liquid investments with original maturities of three months or less from the date of acquisition are

classified as cash equivalents. Amounts in transit from banks for customer credit card and debit card transactions are classified as cash. The banks process the

majority of these amounts within two business days.

Amounts not yet presented for payment to zero balance disbursement accounts of $32 million and $91 million at December 26, 2015 and December 27, 2014,

respectively, are presented in Trade accounts payable and Accrued expenses and other current liabilities.

Cash and cash equivalents held outside the United States at December 26, 2015 amounted to $253 million.

Trade receivables, net, totaled $774 million and $812 million at December 26, 2015 and December 27, 2014, respectively. An allowance for

doubtful accounts has been recorded to reduce receivables to an amount expected to be collectible from customers. The allowance at December 26, 2015 and

December 27, 2014 was $16 million and $18 million, respectively.

Exposure to credit risk associated with trade receivables is limited by having a large customer base that extends across many different industries and

geographic regions. However, receivables may be adversely affected by an economic slowdown in the United States or internationally. No single customer

accounted for more than 10% of total sales or receivables in 2015, 2014 or 2013.

Other receivables are $392 million and $452 million at December 26, 2015 and December 27, 2014, respectively, of which $308 million and $360 million,

respectively, are amounts due from vendors under purchase rebate, cooperative advertising and various other marketing programs.

67