OfficeMax 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Competition Bureau filed an application to block the transaction with the Canadian Competition Tribunal. On February 2, 2016, the Company and Staples

entered into a letter agreement to waive, until May 16, 2016, certain of their respective rights to terminate the Staples Merger Agreement.

The Company has agreed to pay a fee of $185 million to Staples if each of the following conditions are met: (i) the Staples Merger Agreement is terminated

by the Company before the date permitted by the Staples Merger Agreement, as amended, (ii) a third party has made an acquisition proposal before the

termination of the Staples Merger Agreement, and (iii) within 12 months of the termination of the Staples Merger Agreement, the Company enters into an

alternative transaction. Staples is required to pay Office Depot a termination fee of $250 million if the Staples Merger Agreement is terminated in certain

circumstances relating to the antitrust regulatory review process.

Refer to the Company’s Current Report on Form 8-K filed with the SEC on February 4, 2015 for additional information on the transaction. Also, refer to Note

3 for expenses incurred in 2015 related to the Staples Acquisition.

The consolidated financial statements of Office Depot include the accounts of all wholly owned and financially controlled

subsidiaries prior to disposition. Also, variable interest entities formed by OfficeMax in prior periods solely related to the Timber Notes and Non-recourse

debt are consolidated because the Company is the primary beneficiary. Refer to Note 7 for additional information. As a result of the Merger, the Company

owns 88% of a subsidiary that formerly owned assets in Cuba, which were confiscated by the Cuban government in the 1960’s. Due to various asset

restrictions, the fair value of this investment at the Merger date was not determinable and no amounts are included in the consolidated financial statements.

Intercompany transactions have been eliminated in consolidation.

The equity method of accounting is used for investments in which the Company does not control but either shares control equally or has significant

influence; the cost method is used when the Company neither shares control nor has significant influence.

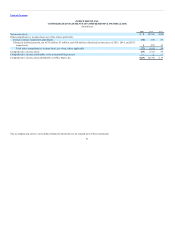

During the fourth quarter of 2015, the Company early adopted the new accounting standard that requires debt issuance costs to be presented as a reduction of

the related liability rather than as an asset and the new accounting standard that requires that all deferred taxes be presented as noncurrent on the

Consolidated Balance Sheets. Amounts reported in the Consolidated Balance Sheet as of December 27, 2014 have been reclassified to conform with current

year presentation, as follows.

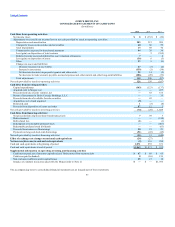

(In millions)

Assets:

Prepaid expenses and other current assets $ 245 $ (87) $ 158

Deferred income taxes — noncurrent 32 4 36

Other assets 242 (4) 238

Total assets 6,844 (87) 6,757

Liabilities:

Accrued expenses and other current liabilities 1,517 (3) 1,514

Deferred income taxes and other long-term liabilities 621 (80) 541

Long term debt, net of current maturities 674 (4) 670

Total liabilities 5,223 (87) 5,136

66