OfficeMax 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

the direct channel, online sales through officedepot.com decreased during 2015 driven by lower sales of technology products, customer attrition from the

decommissioning of legacy OfficeMax e-commerce sites, and lower catalog and call center sales. We anticipate that catalog and call center ordering will

continue to decline with some customers shifting to online shopping. Additionally, online sales picked up in stores increased in 2015 and is expected to

increase in the future. These sales are fulfilled with store inventory and by store personnel and therefore are reported as sales in the North American Retail

Division. These negative impacts on the direct channel sales were partially offset by benefits from an enhanced Internet shopping offering and experience.

The decommissioning of legacy OfficeMax e-commerce sites is expected to streamline operations and lower future operating costs. On a product category

basis for the Division, sales increased in cleaning and breakroom products and declined in core supplies, technology products, furniture, and Copy & Print

Depot.

Sales in 2014 increased in the contract and direct channels compared to the prior year, primarily due to the addition of OfficeMax sales. Direct channel sales

also increased during 2014, reflecting efforts to enhance the Internet shopping offering and experience. The increased online sales were partially offset by

reduced call center sales. Sales in the merged business in Canada declined in the second half of 2014 compared to the first half of 2014, in part reflecting the

closing of Grand & Toy stores during the second quarter of 2014. At the Division level, sales increased across all categories compared to the prior year.

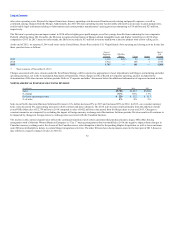

Division operating income was $226 million in 2015, $232 million in 2014, and $113 million in 2013. Division operating income as a percentage of sales

was 4% in 2015 and 2014 and 3% in 2013. Gross profit margin in 2015 was consistent with prior year. Gross margin in 2014 was lower than 2013 resulting,

in part, from the impact of adding OfficeMax contract channel customers with a higher mix of lower margin accounts. Both 2015 and 2014 Division results

reflect lower advertising and payroll expense as a percentage of sales across this Division compared to the respective prior years. These benefits reflect

efficiencies of combining the companies. Offsetting these benefits, Division operating income was negatively impacted by the sales decline on recovery of

fixed operating expenses (the “flow through impact”).

In 2014, the Company closed the 19 Grand & Toy stores in Canada that were added as part of the Merger. These locations primarily serviced contract and

other small business customers and, accordingly, were included in results of the North America Business Solutions Division.

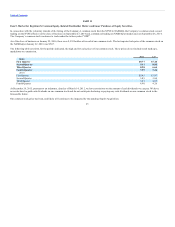

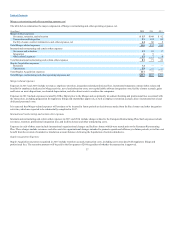

(In millions) 2014 2013

Sales $3,400 $3,008

% change 13% —%

Division operating income $ 53 $ 36

% of sales 2% 1%

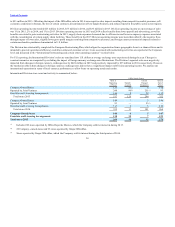

Sales in our International Division in U.S. dollars decreased 18% in 2015 and increased 13% in 2014. On a constant currency basis, sales decreased 6% in

2015 and increased 12% in 2014. Constant currency sales in 2015 were lower in contract and direct channels and higher in the retail channel compared to

prior year. The contract channel sales decline reflects competitive market pressures that contributed to the loss of certain customers in the private and public

sectors, reduced spend from existing customers in the largest European and Pacific markets, and disruptions related to the pending acquisition by Staples.

These declines were partially offset by sales increases in Sweden and smaller European markets. The sales decline in the direct channel reflects the continued

competitive market pressures, disruptions associated with the channel realignment resulting from restructuring activities, and the continued decline in

catalog and call center sales, partially offset by online sales increases. The Company anticipates the customer migration to online purchases and away from

catalogs and call center sales will continue and has added functional capabilities, improved content and developed more effective marketing to grow the

online business. Retail sales increased in Sweden and Korea, partially offset by decreases in France. The 2014 sales increase results primarily from the

addition of OfficeMax sales of $551 million in 2014 compared

33