OfficeMax 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

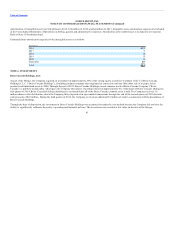

The activity in the merger and restructuring accruals in 2015 and 2014 is presented in the table below. Of the total $332 million and $403 million Merger,

restructuring and other expenses incurred in 2015 and 2014, respectively, $241 million and $266 million are related to merger or restructuring liabilities and

are included as Charges incurred in the table below. The remaining $91 million and $137 million in 2015 and 2014, respectively, are excluded from the table

above because these items are expensed as incurred, non-cash, or otherwise not associated with the merger and restructuring balance sheet accounts (see

further discussion below).

(In millions)

Beginning

Balance

Charges

Incurred

Cash

Payments

Currency,

Lease

Accretion,

and Other

Adjustments

Ending

Balance

Termination benefits:

Merger-related accruals $ 31 $ 16 $ (31) $ — $ 16

European Restructuring Plan 26 53 (32) (5) 42

Other restructuring accruals 8 7 (14) — 1

Lease and contract obligations, accruals for facilities closures and other costs:

Merger-related accruals 71 76 (70) — 77

European Restructuring Plan — 10 (10) 1 1

Other restructuring accruals 35 4 (17) 3 25

Acquired entity accruals 36 3 (15) 1 25

Staples acquisition related accruals — 72 — — 72

Total merger and restructuring accruals $ 207 $ 241 $ (189) $ — $ 259

Termination benefits:

Merger-related accruals $ 23 $ 99 $ (91) $ — $ 31

European Restructuring Plan — 26 — — 26

Other restructuring accruals 5 23 (21) 1 8

Acquired entity accruals 4 — (2) (2) —

Lease and contract obligations, accruals for facilities closures and other costs:

Merger-related accruals 25 111 (65) — 71

European Restructuring Plan — 2 (2) — —

Other restructuring accruals 62 5 (33) 1 35

Acquired entity accruals 59 — (25) 2 36

Total merger and restructuring accruals $ 178 $ 266 $ (239) $ 2 $ 207

The short-term and long-term components of these liabilities are included in Accrued expenses and other current liabilities and Deferred income taxes and

other long-term liabilities, respectively, on the Consolidated Balance Sheets.

The remaining $91 million incurred in 2015 is comprised of $81 million Merger transaction and integration expenses, $6 million European restructuring

integration expenses, $39 million Staples Acquisition transaction expenses, and $1 million associated primarily to fixed assets and rent related expenses,

partially offset by the $36 million gain on the disposition of the warehouse facilities associated with the supply chain integration. The

77