OfficeMax 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

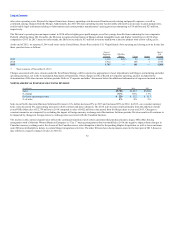

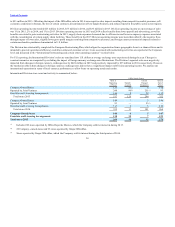

The Company expects total Company sales in 2016 to be lower than 2015, primarily due to its decision to close certain stores, continued business disruption

from the pending Staples Acquisition, challenging market trends in our industry, and the negative impact of currency translation.

Investing Activities

During 2015, $163 million was used for capital expenditures and $9 million was used for acquisition of an interior furniture business. These outflows were

partially offset by $97 million of proceeds from the disposition of assets and other, primarily, the sale of warehouse facilities that previously were classified as

held for sale. Additional facility sales are anticipated as the Real Estate Strategy is implemented. The use of cash in 2014 reflects $123 million of capital

expenditures, partially offset by $43 million proceeds from the disposition of Grupo OfficeMax, $43 million proceeds from the sale of Boise Cascade

Company common stock, and $12 million proceeds from the disposition of assets and other.

The source of cash in 2013 results primarily from $675 million in net proceeds from the disposition of the joint venture Office Depot de Mexico and $460

million in cash acquired from OfficeMax at the Merger date. The cash proceeds from the sale of Office Depot de Mexico provided additional liquidity for the

preferred stock retirement, debt maturity and for the needs of the combined Company for Merger-related expenses. A $35 million return of investment in

Boise Cascade Holdings also contributed to the source of cash in 2013. Capital expenditures in 2013 were $137 million.

Financing Activities

During 2015, payments on short- and long-term borrowings were $51 million, partially offset by proceeds from short- and long-term borrowings of $20

million and employee share-based transactions of $7 million. The 2014 source of cash resulted from net proceeds from exercise of employee share-based

transactions of $39 million and proceeds from borrowings of $21 million. Payments on long and short-term borrowings were $45 million during 2014.

In 2013, the Company redeemed 50% of its preferred stock in July and the remaining 50% in November with total cash payments of $431 million. The

redemption payment of $431 million includes the liquidation preference of $407 million and redemption premium of $24 million, measured at 6% of the

liquidation preference. The premium of $24 million is included in the $63 million dividend of preferred stock. Contractual dividends on preferred stock were

paid in cash in 2013. Also in 2013, the Company repaid the $150 million of 6.25% senior notes at maturity. Net repayments on long and short-term

borrowings were $21 million in 2013.

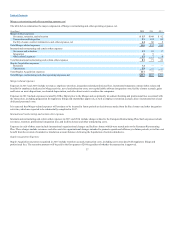

As of December 26, 2015, we lease retail stores and other facilities and equipment under operating lease agreements, which are included in the table below. In

addition, Note 16, “Commitments and Contingencies,” of the Consolidated Financial Statements describes certain of our arrangements that contain

indemnifications.

42