OfficeMax 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

assess goodwill for possible impairment in future periods by considering qualitative factors, rather than this quantitative test.

Amortizable intangible assets are periodically reviewed to determine whether events and circumstances warrant a revision to the remaining period of

amortization or asset impairment. Certain locations identified for closure resulted in impairment of favorable lease assets recorded as part of the Merger.

Long-lived assets with identifiable cash flows are reviewed for possible impairment whenever events or changes in

circumstances indicate that the carrying amount of such assets may not be recoverable. Because of recent operating results and implementation of the post-

Merger real estate strategy (the “Real Estate Strategy”), retail store long-lived assets have been reviewed for impairment indicators quarterly. Impairment is

assessed at the individual store level which is the lowest level of identifiable cash flows, and considers the estimated undiscounted cash flows over the asset’s

remaining life. If estimated undiscounted cash flows are insufficient to recover the investment, an impairment loss is recognized equal to the difference

between the estimated fair value of the asset and its carrying value, net of salvage, and any costs of disposition. The fair value estimate is generally the

discounted amount of estimated store-specific cash flows.

Store performance is regularly reviewed against expectations and stores not meeting performance requirements may

be closed. Additionally, since 2014, the Company has been closing stores in connection with the Real Estate Strategy which is expected to be completed in

2016. Refer to Note 3 for additional information.

Costs associated with facility closures, principally accrued lease costs, are recognized when the facility is no longer used in an operating capacity or when a

liability has been incurred. Store assets are also reviewed for possible impairment, or reduction of estimated useful lives.

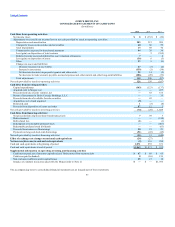

Accruals for facility closure costs are based on the future commitments under contracts, adjusted for assumed sublease benefits and discounted at the

Company’s credit-adjusted risk-free rate at the time of closing. Accretion expense is recognized over the life of the contractual payments. Additionally, the

Company recognizes charges to terminate existing commitments and charges or credits to adjust remaining closed facility accruals to reflect current

expectations. Accretion expense and adjustments to facility closure costs are presented in the Consolidated Statements of Operations in Selling, general and

administrative expenses if the related facility was closed as part of ongoing operations or in Merger, restructuring and other operating expenses, net, if the

related facility was closed as part of Merger or restructuring activities. Refer to Note 3 for additional information on accrued expenses relating to closed

facilities. The short-term and long-term components of this liability are included in Accrued expenses and other current liabilities and Deferred income taxes

and other long-term liabilities, respectively, on the Consolidated Balance Sheets.

Employee termination costs covered under written and substantive plans are accrued when probable and estimable and consider continuing service

requirements, if any. Additionally, incremental one-time employee benefit costs are recognized when the key terms of the arrangements have been

communicated to affected employees. Amounts are recognized when communicated or over the remaining service period, based on the terms of the

arrangements.

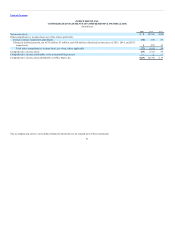

Included in Accrued expenses and other current liabilities in the Consolidated Balance Sheets are accrued payroll-related amounts of

$291 million and $343 million at December 26, 2015 and December 27, 2014, respectively.

69