OfficeMax 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

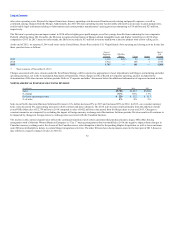

Due to the completion of the Internal Revenue Service (“IRS”) examination for 2013, the Company’s balance of unrecognized tax benefits decreased by $4

million during 2015, which did not impact income tax expense due to an offsetting change in valuation allowance. During 2015, the IRS examination of the

OfficeMax 2012 U.S. federal income tax return concluded, which resulted in a $6 million decrease in tax credit carryforwards. Such decrease had no impact

on income tax expense due to an offsetting change in valuation allowance. It is reasonably possible that certain tax positions will be resolved within the next

12 months, which would decrease the Company’s balance of unrecognized tax benefits by $5 million but would not affect the effective tax rate due to an

offsetting change in valuation allowance. Additionally, the Company anticipates that it is reasonably possible that new issues will be raised or resolved by

tax authorities that may require changes to the balance of unrecognized tax benefits; however, an estimate of such changes cannot reasonably be made.

Refer to Note 9, “Income Taxes,” in the Notes to Consolidated Financial Statements for additional tax discussion.

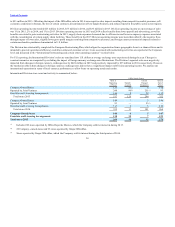

At December 26, 2015, we had $1.1 billion in cash and equivalents and another $1.2 billion available under the Amended Credit Agreement (as defined in

Note 8, “Debt,” of the Consolidated Financial Statements) based on the December 2015 borrowing base certificate, for a total liquidity of $2.2 billion. The

Amended Credit Agreement provides for an asset based, multi-currency revolving credit facility of up to $1.25 billion and expires May 25, 2017. We

consider our resources adequate to satisfy our cash needs for at least the next twelve months.

Cash and cash equivalents held outside the United States, at December 26, 2015, amounted to $253 million and could result in additional tax expense if

repatriated. Refer to Note 9, “Income Taxes” of the Consolidated Financial Statements for additional information.

No amounts were drawn under the Amended Credit Agreement during 2015 and no amounts were outstanding at December 26, 2015. There were letters of

credit outstanding under the Amended Credit Agreement at the end of the year totaling $84 million.

The Company had short-term borrowings of $4 million at December 26, 2015 under various local currency credit facilities for international subsidiaries that

had an effective interest rate at the end of the year of approximately 4%. The maximum month end balance occurred in June 2015 at $6 million and the

maximum monthly average amount occurred in July 2015 at $5 million. The majority of these short-term borrowings represent outstanding balances on

uncommitted lines of credit, which do not contain financial covenants.

The Company was in compliance with all applicable financial covenants at December 26, 2015.

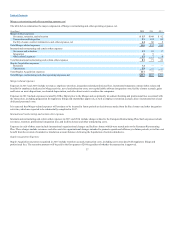

Since the Merger date, we have incurred significant expenses associated with the Merger and integration actions, including costs associated with the Real

Estate Strategy, and we have incurred significant expenses from restructuring activities in Europe. Approximately $100 million of net cash Merger

integration costs are anticipated through the remaining integration period.

In 2016, the Company expects capital expenditures to be approximately $250 million, including approximately $50 million related to Merger integration.

We have entered into the Staples Merger Agreement with Staples and have agreed to pay a fee of $185 million to Staples if each of the following conditions

are met: (i) the Staples Merger Agreement is terminated by the Company before the date permitted by the Staples Merger Agreement, as amended, (ii) a third

party has made an acquisition proposal before the termination of the Staples Merger Agreement, and (iii) within 12 months of the termination of the Staples

Merger Agreement, the Company enters into an alternative transaction. Staples is

40