OfficeMax 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

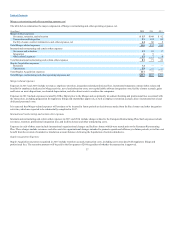

paid over the “notice period.” As of December 26, 2015, purchase obligations include marketing services, outsourced accounting services, certain

fixed assets and software licenses, service and maintenance contracts for information technology and communication. Contracts that can be

unilaterally terminated without a penalty have not been included.

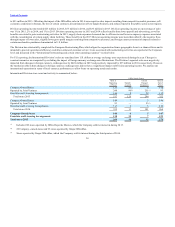

Our Consolidated Balance Sheet as of December 26, 2015 includes $459 million classified as Deferred income taxes and other long-term liabilities. Deferred

income taxes and other long-term liabilities primarily consist of net long-term deferred income taxes, deferred lease credits, long-term restructuring accruals,

certain liabilities under our deferred compensation plans, accruals for uncertain tax positions, and environmental accruals. Certain of these liabilities have

been excluded from the above table as either the amounts are fully funded or the timing and/or the amount of any cash payment is uncertain. Refer to Note 3,

“Merger, Restructuring, and Other Accruals,” for a discussion of our restructuring accruals and Note 9, “Income Taxes,” of the Consolidated Financial

Statements for additional information regarding our deferred tax positions and accruals for uncertain tax positions.

Our Consolidated Balance Sheet as of December 26, 2015 also includes $184 million classified as Pension and postretirement obligations, net, which is also

excluded from the table above, as the timing of the cash payments is uncertain. Our estimate is that payments in future years will total $269 million. This

estimate represents the minimum contributions required per Internal Revenue Service funding rules and the Company’s estimated future payments under

pension and postretirement plans. Actuarially-determined liabilities related to pension and postretirement benefits are recorded based on estimates and

assumptions. Key factors used in developing estimates of these liabilities include assumptions related to discount rates, rates of return on investments,

healthcare cost trends, benefit payment patterns and other factors. Changes in assumptions related to the measurement of funded status could have a material

impact on the amount reported.

In addition to the above, we have outstanding letters of credit totaling $84 million at December 26, 2015.

Our Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America.

Preparation of these statements requires management to make judgments and estimates. Some accounting policies and estimates have a significant impact on

amounts reported in these financial statements. A summary of significant accounting policies can be found in Note 1, “Summary of Significant Accounting

Policies,” of the Consolidated Financial Statements. We have also identified certain accounting policies and estimates that we consider critical to

understanding our business and our results of operations and we have provided below additional information on those policies. No significant changes have

been made during 2015 to the methodologies used in preparing the estimates discussed below.

Merger impacts — The integration of two like companies generally is expected to provide benefits from reduction of duplicate functions and greater

economies of scale. Such benefits will be reflected as lower operating costs as the integration continues. However, the integration also results in significant

costs related to the closure of facilities, severance of employees and incurring incremental costs required to merge the two companies where such costs are not

expected to be incurred in periods following the integration. During 2015, the Company recognized $140 million of Merger costs and costs are expected to

continue through the integration timeline. Also, gains and losses may be recognized from dispositions of properties that are no longer in use following

Merger-related facility consolidation and closure. Gains are recognized when realized; losses are recognized when closure or disposition decisions are made.

These costs, net of gains, are included in Merger, restructuring and other operating expenses, net in the Consolidated Statements of Operations. Refer to the

Long-lived asset impairments, Goodwill and other intangible assets, and Closed store accruals sections below for additional Merger-related impacts. The

accounting policies for the recognition of these Merger costs are the same as those the Company follows for other asset impairments, severance accruals,

facility closure costs and gains and loss on dispositions. Refer to Note 1, “Summary of Significant Accounting Policies,” of the Consolidated Financial

Statements for further discussion of these policies.

44