OfficeMax 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

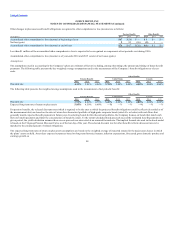

As a global supplier of office products and services the Company is exposed to risks associated with changes in foreign currency exchange rates, fuel and

other commodity prices and interest rates. Depending on the exposure, settlement timeframe and other factors, the Company may enter into derivative

transactions to mitigate those risks. Financial instruments authorized under the Company’s established risk management policy include spot trades, swaps,

options, caps, collars, forwards and futures. Use of derivative financial instruments for speculative purposes is expressly prohibited. The Company may

designate and account for such qualifying arrangements as hedges. As of December 26, 2015, the foreign exchange contracts extend through December 2016

and fuel contracts extended through January 2017.

The fair values of the Company’s foreign currency contracts and fuel contracts are the amounts receivable or payable to terminate the agreements at the

reporting date, taking into account current interest rates, exchange rates and commodity prices. The values are based on market-based inputs or unobservable

inputs that are corroborated by market data. At December 26, 2015, Accrued expenses and other liabilities in the Consolidated Balance Sheets includes $2

million related to derivative fuel contracts.

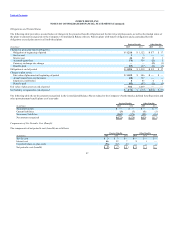

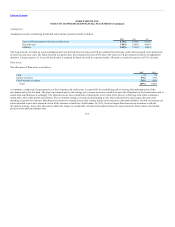

The following table presents information about financial instruments at the balance sheet dates indicated.

2014

(In millions)

Carrying

Value

Fair

Value

Financial assets:

Timber notes receivable $ 926 $930

Company-owned life insurance 82 82

Financial liabilities:

Recourse debt:

9.75% Senior Secured Notes, due 2019 250 280

7.35% debentures, due 2016 18 18

Revenue bonds, due in varying amounts periodically through 2029 186 185

American & Foreign Power Company, Inc. 5% debentures, due 2030 14 13

Non-recourse debt 839 845

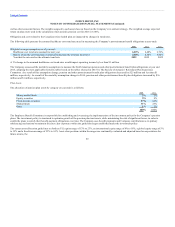

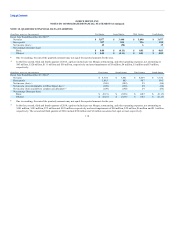

The following methods and assumptions were used to estimate the fair value of each class of financial instruments:

• Fair value is determined as the present value of expected future cash flows discounted at the current interest rate for

loans of similar terms with comparable credit risk (Level 2 measure).

• In connection with the Merger, the Company acquired company-owned life insurance policies on certain

former employees. The fair value of the company-owned life insurance policies is derived using determinable net cash surrender value (Level 2

measure).

107