NetSpend 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Middle East, Africa, Asia Pacific and Brazil. The

Company’s Merchant Services segment provides

merchant services to merchant acquirers and

merchants in the United States.

In 2009, the Merchant Services segment’s revenues

represented approximately 19% of the Company’s

total revenues. As part of its strategic plan to

diversify, the Company acquired companies between

2010 and 2012 to expand the Merchant Services

segment in the direct acquiring business. Refer to

Notes 1 and 24 in the consolidated financial

statements for further information related to these

acquisitions.

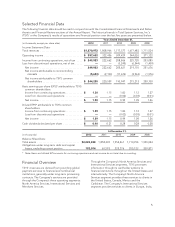

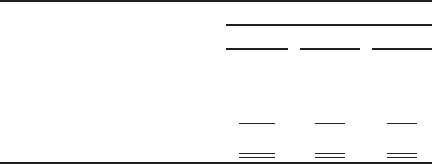

The following table sets forth each segment’s

revenues as a percentage of the Company’s total

revenues:

Years Ended December 31,

2012 2011 2010

North America Services . . 51% 51% 54%

International Services .... 22 22 19

Merchant Services ....... 27 27 27

Total revenues .......... 100% 100% 100%

Due to the somewhat seasonal nature of the credit

card industry, TSYS’ revenues and results of

operations have generally increased in the fourth

quarter of each year because of increased transaction

and authorization volumes during the traditional

holiday shopping season. Furthermore, growth or

declines in card and merchant portfolios of existing

clients, the conversion of cardholder and merchant

accounts of new clients to the Company’s processing

platforms, the receipt of fees for early contract

termination and the loss of cardholder and merchant

accounts either through purges or deconversions

impact the results of operations from period to

period.

Another factor which may affect TSYS’ revenues and

results of operations from time to time is

consolidation in the financial services or retail

industries either through the sale by a client of its

business, its card portfolio or a segment of its

accounts to a party which processes cardholder or

merchant accounts internally or uses another third-

party processor. A change in the economic

environment in the retail sector, or a change in the

mix of payments between cash and cards could

favorably or unfavorably impact TSYS’ financial

position, results of operations and cash flows in the

future.

TSYS’ reported financial results will also be impacted

by significant shifts in currency conversion rates. TSYS

does not view foreign currency as an economic event

for the Company but as a financial reporting issue.

Because changes in foreign currency exchange rates

distort the operating growth rates, TSYS discloses the

impact of foreign currency translation on its financial

performance.

A significant amount of the Company’s revenues is

derived from long-term contracts with large clients.

Processing contracts with large clients, representing a

significant portion of the Company’s total revenues,

generally provide for discounts on certain services

based on the size and activity of clients’ portfolios.

Therefore, revenues and the related margins are

influenced by the client mix relative to the size of

client portfolios, as well as the number and activity of

individual cardholder or merchant accounts

processed for each client. Consolidation among

financial institutions has resulted in an increasingly

concentrated client base, which results in a change in

client mix toward larger clients.

Economic Conditions

Many of TSYS’ businesses rely in part on the number

of consumer credit transactions which had been

reduced by a weakened U.S. and world economy and

difficult credit markets. As a result of these economic

conditions in the U.S., credit card issuers had been

reducing credit limits and closing accounts and were

more selective with respect to whom they issue credit

cards. However, general economic conditions in the

U.S. and other areas of the world have shown

improvement during 2010, 2011 and 2012. These

improved economic conditions led card issuers to

increase card solicitations. Continued improvement

of economic conditions in the U.S. could positively

impact future revenues and profits of the Company.

Regulation

Government regulation affects key areas of TSYS’

business, in the U.S. as well as internationally. As a

result of the financial crisis, TSYS, along with the rest

of the financial services industry, continues to

experience increased legislative and regulatory

scrutiny, including the enactment of additional

legislative and regulatory initiatives such as the

Dodd-Frank Wall Street Reform and Consumer

Protection Act (Financial Reform Act). This legislation,

which provides for sweeping financial regulatory

reform, may have a significant and negative impact

on the Company’s clients, which could impact TSYS’

6