NetSpend 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

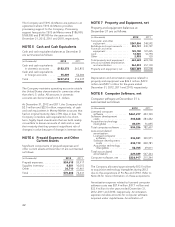

software development costs was $23.3 million, $24.4

million and $23.1 million for the years ended

December 31, 2012, 2011 and 2010, respectively.

Amortization expense related to acquisition

technology intangibles was $9.7 million, $10.3 million

and $9.9 million for the years ended December 31,

2012, 2011 and 2010, respectively.

During the year ended December 31, 2011, the

Company recognized an impairment loss of $960,000

related to the Japan Retail Gift program.

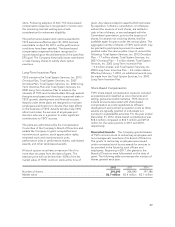

The weighted average useful life for each component

of computer software, and in total, at December 31,

2012, is as follows:

Weighted

Average

Amortization

Period (Yrs)

Licensed computer software ......... 5.5

Software development costs ........ 5.9

Acquisition technology intangibles . . . 6.6

Total ............................ 5.8

Estimated future amortization expense of licensed

computer software, software development costs and

acquisition technology intangibles as of

December 31, 2012 for the next five years is:

(in thousands)

Licensed

Computer

Software

Software

Development

Costs

Acquisition

Technology

Intangibles

2013 ...... $35,676 25,345 10,306

2014 ...... 31,020 19,025 8,471

2015 ...... 24,521 13,331 5,426

2016 ...... 15,911 9,028 3,958

2017 ...... 11,153 4,734 2,474

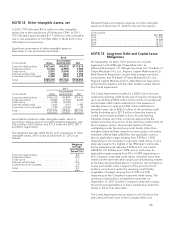

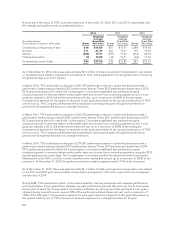

NOTE 9 Contract Acquisition Costs, net

Significant components of contract acquisition

costs at December 31 are summarized as

follows:

(in thousands) 2012 2011

Conversion costs, net ....... $ 85,402 88,765

Payments for processing

rights, net ............... 75,865 74,222

Total ..................... $161,267 162,987

Amortization related to payments for processing

rights, which is recorded as a reduction of revenues,

was $13.3 million, $15.9 million and $17.7 million for

2012, 2011 and 2010, respectively.

Amortization expense related to conversion costs was

$24.1 million, $18.8 million and $17.5 million for

2012, 2011 and 2010, respectively.

During the year ended December 31, 2011, the

Company recognized an impairment loss related to

payments for processing rights of $750,000 and an

impairment loss related to conversion costs of

$49,000.

The weighted average useful life for each component

of contract acquisition costs, and in total, at

December 31, 2012 is as follows:

Weighted

Average

Amortization

Period (Yrs)

Payments for processing rights ....... 12.6

Conversion costs .................. 9.4

Total ............................ 11.0

Estimated future amortization expense on payments

for processing rights and conversion costs as of

December 31, 2012 for the next five years is:

(in thousands) Conversion

Costs Payments for

Processing Rights

2013 ............. $17,769 14,622

2014 ............. 16,699 13,460

2015 ............. 15,715 11,552

2016 ............. 13,059 9,181

2017 ............. 9,316 7,240

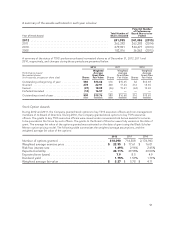

NOTE 10 Goodwill

During 2012, the Company allocated $162.1 million

to goodwill due to the acquisitions of ProPay and

CPAY. During 2011, the Company allocated $28.9

million to goodwill due to the acquisition of TermNet.

In May 2011, TSYS made a payment of $6.0 million of

contingent merger consideration in connection with

the purchase of Infonox on the Web (Infonox), which

was recorded as goodwill.

Refer to Note 24 for more information on

acquisitions.

43