NetSpend 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

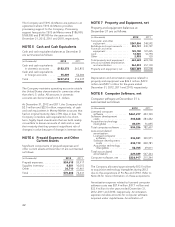

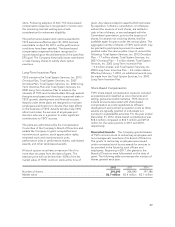

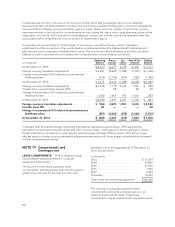

NOTE 12 Other Intangible Assets, net

In 2012, TSYS allocated $76.6 million to other intangible

assets due to the acquisitions of ProPay and CPAY. In 2011,

TSYS allocated approximately $11.7 million to other intangible

due to the acquisition of TermNet. Refer to Note 24 for more

information on acquisitions.

Significant components of other intangible assets at

December 31 are summarized as follows:

2012

(in thousands) Gross Accumulated

Amortization Net

Customer relationships ....$167,641 (49,822) $117,819

Trade association ......... 10,000 (2,750) 7,250

Trade name .............. 2,537 (1,504) 1,033

Channel relationships ...... 1,600 (266) 1,334

Covenants-not-to-compete . 3,440 (822) 2,618

Total ....................$185,218 (55,164) $130,054

2011

(in thousands) Gross Accumulated

Amortization Net

Customer relationships .......$106,312 (34,899) $71,413

Trade association ............ 10,000 (1,750) 8,250

Trade name ................ 2,024 (2,024) —

Channel relationships ........ 1,600 (107) 1,493

Covenants-not-to-compete.... 1,140 (1,046) 94

Total ......................$121,076 (39,826) $81,250

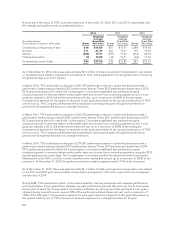

Amortization related to other intangible assets, which is

recorded in selling, general and administrative expenses, was

$16.6 million, $13.2 million and $11.2 million for 2012, 2011

and 2010, respectively.

The weighted average useful life for each component of other

intangible assets, and in total, at December 31, 2012 is as

follows:

Weighted

Average

Amortization

Period (Yrs)

Customer relationships ....................... 8.2

Trade association ............................ 10.0

Trade name ................................. 2.7

Channel relationships ........................ 10.0

Covenants-not-to-compete .................... 2.9

Total ...................................... 8.1

Estimated future amortization expense on other intangible

assets as of December 31, 2012 for the next five years is:

(in thousands)

2013 ........................................... $21,885

2014 ........................................... 21,445

2015 ........................................... 19,669

2016 ........................................... 19,111

2017 ........................................... 18,721

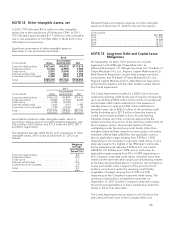

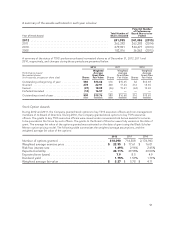

NOTE 13 Long-term Debt and Capital Lease

Obligations

On September 10, 2012, TSYS entered into a Credit

Agreement with JPMorgan Chase Bank, N.A., as

Administrative Agent, J.P. Morgan Securities LLC, The Bank of

Tokyo-Mitsubishi UFJ, Ltd., Regions Capital Markets and U.S.

Bank National Association, as joint lead arrangers and joint

bookrunners, and The Bank of Tokyo-Mitsubishi UFJ, Ltd.,

Regions Capital Markets and U.S. Bank National Association,

as Syndication Agents, and the other lenders named therein

(the Credit Agreement).

The Credit Agreement provides for a $350 million five-year

unsecured revolving credit facility (which may be increased by

up to an additional $350 million under certain circumstances)

and includes a $50 million subfacility for the issuance of

standby letters of credit and a $50 million subfacility for

swingline loans. Up to $262.5 million of the revolving credit

facility (including up to $37.5 million of standby letters of

credit) can be made available in Euro, Pounds Sterling,

Canadian Dollars and other currencies approved by the

lenders providing this portion of the revolving credit facility. At

the Company’s option, the principal balance of loans

outstanding under the revolving credit facility (other than

swingline loans) will bear interest at a rate equal to (i) London

Interbank Offered Rate (LIBOR) for the applicable currency

plus an applicable margin ranging from 0.90% to 1.45%

depending on the Company’s corporate credit rating, or (ii) a

base rate equal to the highest of (a) JPMorgan’s prime rate,

(b) the Federal Funds rate plus 0.50% and (c) one-month

LIBOR for U.S. Dollars plus 1.00%, plus in each case, an

applicable margin ranging from 0% to 0.45% depending on

the Company’s corporate credit rating. Swingline loans bear

interest at the same rate and margins as loans bearing interest

at the base rate described above. In addition, the Company is

to pay each lender a fee in respect of the amount of such

lender’s commitment under the revolving credit facility

(regardless of usage), ranging from 0.10% to 0.30%

depending on the Company’s corporate credit rating. The

revolving credit facility is scheduled to terminate on

September 10, 2017 and the Company is required to repay

the entire principal balance of loans outstanding under this

facility in full on that same date.

The Credit Agreement also provides for a $150 million five-

year unsecured term loan to the Company which was

45