NetSpend 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Noncontrolling interest in earnings of subsidiaries

represents the minority shareholders’ share of the net

income or loss of GP Network Corporation (GP Net)

and TSYS Managed Services EMEA Ltd. (TSYS

Managed Services). The noncontrolling interest in the

Consolidated Balance Sheet reflects the original

investment by these shareholders in GP Net and

TSYS Managed Services, their proportional share of

the earnings or losses and their proportional share of

net gains or losses resulting from the currency

translation of assets and liabilities of GP Net and

TSYS Managed Services. TSYS has adopted the

accounting policy to recognize gains or losses on

equity transactions of a subsidiary as a capital

transaction.

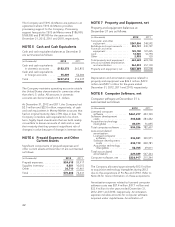

RESERVE FOR MERCHANT LOSSES: The

Company has potential liability for losses resulting

from disputes between a cardholder and a merchant

that arise as a result of, among other things, the

cardholder’s dissatisfaction with merchandise quality

or merchant services. Such disputes may not be

resolved in the merchant’s favor. In these cases, the

transaction is “charged back” to the merchant, which

means the purchase price is refunded to the

customer by the card-issuing bank and charged to

the merchant. If the merchant is unable to fund the

refund, TSYS must do so. TSYS also bears the risk of

reject losses arising from the fact that TSYS collects

fees from its merchants on the first day after the

monthly billing period. If the merchant has gone out

of business during such period, TSYS may be unable

to collect such fees. TSYS maintains cash deposits or

requires the pledge of a letter of credit from certain

merchants, generally those with higher average

transaction size where the card is not present when

the charge is made or the product or service is

delivered after the charge is made, in order to offset

potential contingent liabilities such as chargebacks

and reject losses that would arise if the merchant

went out of business. Most chargeback and reject

losses are charged to cost of services as they are

incurred. However, the Company also maintains a

reserve against losses, including major fraud losses,

which are both less predictable and involve larger

amounts. The loss reserve was established using

historical loss rates, applied to recent bankcard

processing volume. At December 31, 2012, the

Company had a merchant loss reserve in the amount

of $906,000.

FOREIGN CURRENCY TRANSLATION: The

Company maintains several different foreign

operations whose functional currency is their local

currency. Foreign currency financial statements of the

Company’s Mexican and Chinese equity investments,

the Company’s wholly owned subsidiaries and the

Company’s majority owned subsidiaries, as well as

the Company’s division and branches in the United

Kingdom and China, are translated into U.S. dollars at

current exchange rates, except for revenues, costs

and expenses, and net income which are translated at

the average exchange rates for each reporting

period. Net gains or losses resulting from the

currency translation of assets and liabilities of the

Company’s foreign operations, net of tax when

applicable, are accumulated in a separate section of

shareholders’ equity titled accumulated other

comprehensive income (loss). Gains and losses on

transactions denominated in currencies other than

the functional currencies are included in determining

net income for the period in which exchange rates

change.

COMPREHENSIVE INCOME: The provisions of

ASC 220, “Comprehensive Income,” require

companies to display, with the same prominence as

other financial statements, the components of

comprehensive income (loss). TSYS displays the items

of other comprehensive income (loss) in its

Consolidated Statements of Other Comprehensive

Income, which directly follows the Consolidated

Statements of Income.

TREASURY STOCK: The Company uses the cost

method when it purchases its own common stock as

treasury shares or issues treasury stock upon option

exercises and displays treasury stock as a reduction of

shareholders’ equity.

DERIVATIVE INSTRUMENTS AND HEDGING

ACTIVITIES: ASC 815, “Derivatives and Hedging”

requires that all derivative instruments be recorded

on the balance sheet at their respective fair values.

The Company did not have any outstanding

derivative instruments or hedging transactions at

December 31, 2012.

REVENUE RECOGNITION: The Company

recognizes revenues in accordance with the

provisions of SAB No. 104. SAB No. 104 sets forth

guidance as to when revenue is realized or realizable

and earned when all of the following criteria are met:

(1) persuasive evidence of an arrangement exists; (2)

delivery has occurred or services have been

performed; (3) the seller’s price to the buyer is fixed

or determinable; and (4) collectability is reasonably

assured. The Company accrues for rights of refund,

processing errors or penalties, or other related

allowances based on historical experience.

36