NetSpend 2012 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

foreign currency translation, and $14.8 million of lost

business. The $59.8 million increase in segment total

revenues for 2011, as compared to 2010, is

attributable to a $43.2 million increase in new

business and organic growth and a $16.8 million

increase related to the impact of foreign currency

translation, which is partially offset by lost business.

The segment revenues for 2011 also included a

deconversion fee received from a client for the

discontinuance of an account portfolio.

TSYS terminated its Japan Gift Card program in

February 2013 due to negative future cash flows

resulting from the loss of two of the Gift Card

program’s major customers. The program’s negative

future cash flows indicated that the carrying value of

its assets would not be recovered. As a result, a

provision for the program’s future losses was made

and its assets were written down to zero.

Movements in foreign currency exchange rates as

compared to the U.S. dollar can result in foreign

denominated financial statements being translated

into fewer U.S. dollars, which impact the comparison

to prior periods when the U.S. dollar was weaker. For

2013, TSYS does not expect any significant

movements from the rates that existed at

December 31, 2012.

Merchant Services

The Merchant Services segment provides merchant

services and related services to clients based

primarily in the United States. Merchant services

revenues are derived from providing processing

services, acquiring solutions, related systems and

integrated support services to merchant acquirers

and merchants. Revenues from merchant services

include processing all payment forms including

credit, debit, prepaid, electronic benefit transfer and

electronic check for merchants of all sizes across a

wide array of market verticals. Merchant services

include authorization and capture of transactions;

clearing and settlement of transactions; information

reporting services related to transactions; merchant

billing services; and point-of-sale equipment sales

and service.

The revenues of the Merchant Services segment

increased due to the acquisitions of Central Payment

Co., LLC (CPAY) in 2012, TermNet Merchant Services,

Inc. (TermNet) in 2011, and TSYS Merchant Solutions

(TMS) in 2010. For more information on these

acquisitions, please see Note 24 in the consolidated

financial statements.

This segment has one major customer.

Below is a summary of the Merchant Services segment:

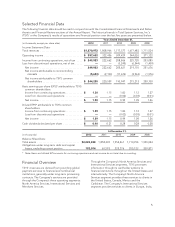

Years Ended December 31, Percent Change

(in millions) 2012 2011 2010

2012

vs.

2011

2011

vs.

2010

Total revenues ..................................................... $ 512.6 488.0 458.9 5.0% 6.3%

Reimbursable items ................................................. 102.9 114.8 121.7 (10.4) (5.7)

Operating income* .................................................. 132.1 113.0 102.4 16.9 10.3

Operating margin* .................................................. 25.8% 23.2% 22.3%

Key indicators:

Point-of-sale transactions ........................................... 4,877.6 4,955.5 5,315.4 (1.6) (6.8)

Dollar sales volume ................................................ 38,864.2 33,674.2 23,556.4 15.4 43.0

* Note: Segment operating results do not include expenses associated with Corporate Administration. Refer to Note 22 for

more information on operating segments.

The $24.6 million increase in segment total revenues for 2012, as compared to 2011, is attributable to a

$27.1 million increase for acquisitions and $16.9 million in new business and internal growth partially offset by

$7.3 million associated with lost business, deconversions, and price compression, and a $11.9 million decrease in

reimbursable items. The $29.1 million increase in segment total revenues for 2011, as compared to 2010, is

attributable to a $42.4 million increase for acquisitions partially offset by lower volume, the impact of the Durbin

amendment, deconversions, and price compression.

The Merchant Services segment results are driven by dollar sales volume and the authorization and capture

transactions processed at the point-of-sale and clearing and settlement transactions. This segment’s authorization

and capture transactions are primarily through dial-up or Internet connectivity.

15