NetSpend 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.including assumptions regarding industry economic

factors and business strategies, and result in an

impairment or a new allocation of purchase price.

Given its history of acquisitions, TSYS may allocate

part of the purchase price of future acquisitions to

contingent consideration as required by GAAP for

business combinations. The fair value calculation of

contingent consideration will involve a number of

assumptions that are subjective in nature and which

may differ significantly from actual results. TSYS may

experience volatility in its earnings to some degree in

future reporting periods as a result of these fair value

measurements.

PRINCIPLES OF CONSOLIDATION AND BASIS OF

PRESENTATION: The accompanying consolidated

financial statements include the accounts of TSYS and

its majority owned subsidiaries. All significant

intercompany accounts and transactions have been

eliminated in consolidation. In addition, the Company

evaluates its relationships with other entities to

identify whether they are variable interest entities as

defined in accordance with the provisions of

Accounting Standards Codification (ASC) 810,

“Consolidation,” and to assess whether it is the

primary beneficiary of such entities. If the

determination is made that the Company is the

primary beneficiary, then that entity is included in the

consolidated financial statements in accordance with

ASC 810.

RISKS AND UNCERTAINTIES AND USE OF

ESTIMATES: Factors that could affect the

Company’s future operating results and cause actual

results to vary materially from expectations include,

but are not limited to, lower than anticipated growth

from existing clients, an inability to attract new clients

and grow internationally, loss of a major customer or

other significant client, loss of a major supplier, an

inability to grow through acquisitions or successfully

integrate acquisitions, an inability to control

expenses, technology changes, the impact of the

application of and/or changes in accounting

principles, financial services consolidation, changes in

regulatory requirements, a decline in the use of cards

as a payment mechanism, disruption of the

Company’s international operations, breach of the

Company’s security systems, a decline in the financial

stability of the Company’s clients and uncertain

economic conditions. Negative developments in

these or other risk factors could have a material

adverse effect on the Company’s financial position,

results of operations and cash flows.

The Company has prepared the accompanying

consolidated financial statements in conformity with

accounting principles generally accepted in the

United States of America. The preparation of the

consolidated financial statements requires

management of the Company to make a number of

estimates and assumptions relating to the reported

amounts of assets and liabilities at the date of the

consolidated financial statements and the reported

amounts of revenues and expenses during the

period. These estimates and assumptions are

developed based upon all information available.

Actual results could differ from estimated amounts.

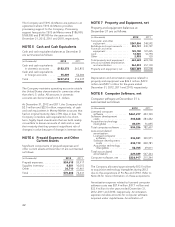

CASH EQUIVALENTS: Investments with a maturity

of three months or less when purchased are

considered to be cash equivalents.

ACCOUNTS RECEIVABLE: Accounts receivable

balances are stated net of allowances for doubtful

accounts and billing adjustments of $3.9 million and

$4.1 million at December 31, 2012 and

December 31, 2011, respectively.

TSYS records an allowance for doubtful accounts

when it is probable that the accounts receivable

balance will not be collected. When estimating the

allowance for doubtful accounts, the Company takes

into consideration such factors as its day-to-day

knowledge of the financial position of specific clients,

the industry and size of its clients, the overall

composition of its accounts receivable aging, prior

history with specific customers of accounts receivable

write-offs and prior experience of allowances in

proportion to the overall receivable balance. This

analysis includes an ongoing and continuous

communication with its largest clients and those

clients with past due balances. A financial decline of

any one of the Company’s large clients could have a

material adverse effect on collectability of receivables

and thus the adequacy of the allowance for doubtful

accounts.

Increases in the allowance for doubtful accounts are

recorded as charges to bad debt expense and are

reflected in selling, general and administrative

expenses in the Company’s Consolidated Statements

of Income. Write-offs of uncollectible accounts are

charged against the allowance for doubtful accounts.

TSYS records an allowance for billing adjustments for

actual and potential billing discrepancies. When

estimating the allowance for billing adjustments, the

Company considers its overall history of billing

adjustments, as well as its history with specific clients

and known disputes. Increases in the allowance for

32