NetSpend 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In connection with the TermNet acquisition, TSYS

incurred $192,000 in acquisition-related costs

primarily related to professional legal, finance, and

accounting costs. These costs were expensed as

incurred and are included in selling, general, and

administrative expenses in the income statement for

2011.

Other

On October 1, 2011, TSYS acquired contract-based

intangible assets in its Merchant Services segment for

$2.6 million. These intangible assets are being

amortized on a straight-line basis over their estimated

useful lives of five years.

In May 2011, TSYS made a payment of $6.0 million of

contingent merger consideration in connection with

the purchase of Infonox, which was accounted for

under SFAS No. 141. The payment of the contingent

merger consideration by TSYS was recorded as

goodwill and had no impact on our results of

operations.

2010

On March 1, 2010, TSYS announced the signing of an

Investment Agreement with First National Bank of

Omaha (FNBO) to form a new joint venture company,

First National Merchant Solutions (FNMS). On

January 4, 2011, TSYS announced it had acquired the

remaining 49% interest in FNMS, effective January 1,

2011, from FNBO. The entity was rebranded as TSYS

Merchant Solutions (TMS).

TMS offers transaction processing, merchant support

and underwriting, and business and value-added

services, as well as Visa- and MasterCard-branded

prepaid cards for businesses of any size.

Under the terms of the Investment Agreement, TSYS

acquired 51% ownership of FNMS Holding, LLC

(FNMS Holding), which owned 100% of FNMS, for

approximately $150.5 million, while FNBO owned the

remaining 49%. The transaction closed on April 1,

2010.

The goodwill amount of $155.5 million arising from

the acquisition consists largely of economies of scale

expected to be realized from combining the

operations of TSYS and TMS. TMS is included within

the Merchant Services segment, and as such, all of

the goodwill was assigned to that segment. The

goodwill recognized is expected to be deductible for

income tax purposes.

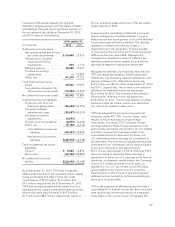

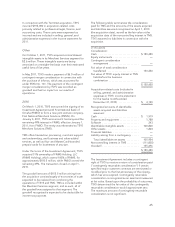

The following table summarizes the consideration

paid for TMS and the amounts of the assets acquired

and liabilities assumed recognized on April 1, 2010

(the acquisition date), as well as the fair value at the

acquisition date of the noncontrolling interest in TMS.

TSYS assumed no liabilities in connection with the

acquisition.

(in thousands)

Consideration:

Cash .............................. $150,450

Equity instruments ................... —

Contingent consideration

arrangement ...................... —

Fair value of total consideration

transferred ....................... 150,450

Fair value of TSYS’ equity interest in TMS

held before the business

combination ...................... —

$ 150,450

Acquisition-related costs (included in

selling, general, and administrative

expenses in TSYS’ income statement

for the twelve months ended

December 31, 2010) ............... $ 4,130

Recognized amounts of identifiable

assets acquired and liabilities

assumed:

Cash .............................. $ 1,919

Property and equipment .............. 1,788

Software ........................... 243

Identifiable intangible assets .......... 100,800

Other assets ........................ 1,204

Financial liabilities ................... —

Liability arising from a contingency ..... —

Total identifiable net assets ......... 105,954

Noncontrolling interest in TMS ......... (111,000)

Goodwill ........................... 155,496

$ 150,450

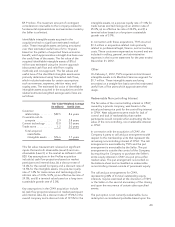

The Investment Agreement includes a contingent

right of TSYS to receive a return of consideration paid

(“contingently returnable consideration”) if certain

specified major customer contracts are terminated or

modified prior to the first anniversary of the closing,

which has since expired. Contingently returnable

consideration is recognized as an asset and measured

at fair value. Based upon the probability of outcomes,

TSYS determined the fair value of the contingently

returnable consideration would approximate zero.

The maximum amount of contingently returnable

consideration is not significant.

65