NetSpend 2012 Annual Report Download - page 38

Download and view the complete annual report

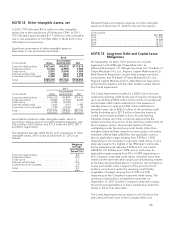

Please find page 38 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.maturities of these assets and liabilities. The fair value

of the Company’s long-term debt and obligations

under capital leases is not significantly different from

its carrying value.

Investments in equity investments are accounted for

using the equity method of accounting and pertain to

privately held companies for which fair value is not

readily available. The Company believes the fair

values of its investments in equity investments

exceed their respective carrying values.

IMPAIRMENT OF LONG-LIVED ASSETS: In

accordance with ASC 360, the Company reviews

long-lived assets, such as property and equipment

and intangibles subject to amortization, including

contract acquisition costs and certain computer

software, for impairment whenever events or changes

in circumstances indicate that the carrying amount of

an asset may not be recoverable. Recoverability of

assets to be held and used is measured by a

comparison of the carrying amount of an asset to

estimated undiscounted future cash flows expected

to be generated by the asset. If upon a triggering

event the Company determines that the carrying

amount of an asset exceeds its estimated

undiscounted future cash flows, an impairment

charge is recognized by the amount by which the

carrying amount of the asset exceeds the fair value of

the asset. Assets to be disposed of would be

separately presented in the balance sheet and

reported at the lower of the carrying amount or fair

value less costs to sell, and would no longer be

depreciated. The assets and liabilities of a disposed

group classified as held for sale would be presented

separately in the appropriate asset and liability

sections of the balance sheet.

TRANSACTION PROCESSING PROVISIONS: The

Company has recorded an accrual for contract

contingencies (performance penalties) and

processing errors. A significant number of the

Company’s contracts with large clients contain

service level agreements which can result in TSYS

incurring performance penalties if contractually

required service levels are not met. When providing

for these accruals, the Company takes into

consideration such factors as the prior history of

performance penalties and processing errors

incurred, actual contractual penalties inherent in the

Company’s contracts, progress towards milestones

and known processing errors not covered by

insurance.

These accruals are included in other current liabilities

in the accompanying Consolidated Balance Sheets.

Increases and decreases in transaction processing

provisions are charged to cost of services in the

Company’s Consolidated Statements of Income, and

payments or credits for performance penalties and

processing errors are charged against the accrual.

REDEEMABLE NONCONTROLLING

INTEREST: In connection with the acquisition of

CPAY, the Company is party to call and put

arrangements with respect to the membership units

that represent the remaining noncontrolling interest

of CPAY. The call arrangement is exercisable by TSYS

and the put arrangement is exercisable by the Seller.

The put arrangement is outside the control of the

Company by requiring the Company to purchase the

Seller’s entire equity interest in CPAY at a put price at

fair market value. The put arrangement is recorded

on the balance sheet and is classified as redeemable

noncontrolling interest outside of permanent equity.

The call and put arrangements for CPAY,

representing 40% of its total outstanding equity

interests, may be exercised at the discretion of TSYS

or the Seller on the second anniversary of the closing

and upon the occurrence of certain other specified

events.

The put option is not currently redeemable, but a

redemption is considered probable based upon the

passage of time of the second anniversary date. As

such, the Company has adopted the accounting

policy to accrete changes in the redemption value

over the period from the date of issuance to the

earliest redemption date, which the Company

believes to be two years. If the put option was

currently redeemable, the redemption value at

December 31, 2012 is estimated to be approximately

$39.5 million. The Company did not accrete any

changes to the redemption value as the balance at

December 31, 2012 exceeded the accretion fair value

amount.

NONCONTROLLING INTEREST: In December

2007, the Financial Accounting Standards Board

(FASB) issued authoritative guidance under ASC 810,

“Consolidation.” ASC 810 changes the accounting

for noncontrolling (minority) interests in consolidated

financial statements, including the requirements to

classify noncontrolling interests as a component of

consolidated shareholders’ equity, the elimination of

“minority interest” accounting in results of operations

and changes in the accounting for both increases and

decreases in a parent’s controlling ownership

interest.

35