NetSpend 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

NOTE 1 Basis of Presentation and

Summary of Significant

Accounting Policies

BUSINESS: Total System Services, Inc.‘s (TSYS’ or

the Company’s) revenues are derived from providing

global payment services to financial and nonfinancial

institutions, generally under long-term processing

contracts. The Company’s services are provided

through the Company’s three operating segments:

North America Services, International Services and

Merchant Services.

Through the Company’s North America Services and

International Services segments, TSYS processes

information through its cardholder systems to

financial institutions throughout the United States and

internationally. The Company’s North America

Services segment provides these services to clients in

the United States, Canada, Mexico and the

Caribbean. The Company’s International Services

segment provides services to clients in Europe, India,

Middle East, Africa, Asia Pacific and Brazil. The

Company’s Merchant Services segment provides

merchant services to merchant acquirers and

merchants in the United States.

On December 26, 2012, TSYS completed its

acquisition of all of the outstanding stock of ProPay,

Inc (ProPay). ProPay previously operated as a

privately-held company, and offers simple, secure

and affordable payment solutions for organizations

ranging from small, home based entrepreneurs to

multi-billion dollar enterprises.

On August 8, 2012, TSYS completed its acquisition of

60% of Central Payment Co., LLC (CPAY), a privately

held direct merchant acquirer. CPAY provides

merchant services to small- to medium-sized

merchants through an Independent Sales Agent (ISA)

model, with a focus on merchants in the restaurant,

personal services and retail sectors.

On May 2, 2011, TSYS completed its acquisition of all

of the outstanding common stock of TermNet

Merchant Services, Inc. (TermNet), an Atlanta-based

merchant acquirer.

On March 1, 2010, TSYS announced the signing of an

Investment Agreement with First National Bank of

Omaha (FNBO) to form a new joint venture company,

First National Merchant Solutions, LLC (FNMS), of

which TSYS would own 51%. FNMS offers transaction

processing, merchant support and underwriting, and

value-added services, as well as Visa- and

MasterCard-branded prepaid cards for businesses of

any size. FNMS is included in the Merchant Services

segment. The effective date of the acquisition was

April 1, 2010. On January 4, 2011, TSYS announced

that it acquired, effective January 1, 2011, the

remaining 49% interest in FNMS, from FNBO. The

company was rebranded as TSYS Merchant Solutions

(TMS).

Refer to Note 24 for more information on

acquisitions.

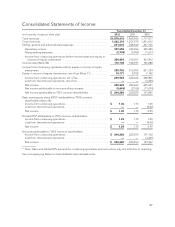

As a result of the sale of certain assets and liabilities

of TSYS POS Systems and Services, LLC (TPOS) in

2010, as discussed in Note 2, the Company’s financial

statements reflect TPOS as discontinued operations.

The Company segregated operating results from

continuing operations in Consolidated Statements of

Income for 2010.

ACQUISITIONS — PURCHASE PRICE

ALLOCATION: TSYS adopted revised generally

accepted accounting principles (GAAP) relating to

business combinations as of January 1, 2009. The

revised guidance retains the purchase method of

accounting for acquisitions and requires a number of

changes to the previous guidance, including changes

in the way assets and liabilities are recognized in

purchase accounting. Other changes include

requiring the recognition of assets acquired and

liabilities assumed arising from contingencies,

requiring the capitalization of in-process research and

development at fair value, and requiring the

expensing of acquisition-related costs as incurred.

TSYS’ purchase price allocation methodology

requires the Company to make assumptions and to

apply judgment to estimate the fair value of acquired

assets and liabilities. TSYS estimates the fair value of

assets and liabilities based upon appraised market

values, the carrying value of the acquired assets and

widely accepted valuation techniques, including

discounted cash flows and market multiple analyses.

Management determines the fair value of fixed assets

and identifiable intangible assets such as developed

technology or customer relationships, and any other

significant assets or liabilities. TSYS adjusts the

purchase price allocation, as necessary, up to one

year after the acquisition closing date as TSYS

obtains more information regarding asset valuations

and liabilities assumed. Unanticipated events or

circumstances may occur which could affect the

accuracy of the Company’s fair value estimates,

31