NetSpend 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company and TSYS de México are parties to an

agreement where TSYS de México provides

processing support to the Company. Processing

support fees paid to TSYS de México were $186,000,

$168,000 and $149,000 for the years ended

December 31, 2012, 2011 and 2010, respectively.

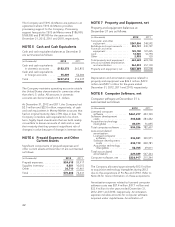

NOTE 5 Cash and Cash Equivalents

Cash and cash equivalent balances at December 31

are summarized as follows:

(in thousands) 2012 2011

Cash and cash equivalents

in domestic accounts .... $152,373 263,853

Cash and cash equivalents

in foreign accounts ..... 95,239 52,484

Total ................... $247,612 316,337

The Company maintains operating accounts outside

the United States denominated in currencies other

than the U.S. dollar. All amounts in domestic

accounts are denominated in U.S. dollars.

At December 31, 2012 and 2011, the Company had

$2.5 million and $22.0 million, respectively, of cash

and cash equivalents in Money Market accounts that

had an original maturity date of 90 days or less. The

Company considers cash equivalents to be short-

term, highly liquid investments that are both readily

convertible to known amounts of cash and so near

their maturity that they present insignificant risk of

changes in value because of change in interest rates.

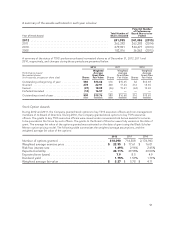

NOTE 6 Prepaid Expenses and Other

Current Assets

Significant components of prepaid expenses and

other current assets at December 31 are summarized

as follows:

(in thousands) 2012 2011

Prepaid expenses ............. $24,615 20,917

Supplies inventory ............ 8,881 10,053

Other ....................... 36,710 41,461

Total ....................... $70,206 72,431

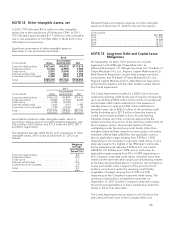

NOTE 7 Property and Equipment, net

Property and equipment balances at

December 31 are as follows:

(in thousands) 2012 2011

Computer and other

equipment ................. $247,506 248,592

Buildings and improvements .... 232,141 230,797

Furniture and other

equipment ................. 125,100 127,425

Land ........................ 16,920 16,794

Other ....................... 2,955 130

Total property and equipment . . 624,622 623,738

Less accumulated depreciation

and amortization ............ 364,233 357,130

Property and equipment, net . . . $260,389 266,608

Depreciation and amortization expense related to

property and equipment was $46.3 million, $49.3

million and $50.1 million for the years ended

December 31, 2012, 2011 and 2010, respectively.

NOTE 8 Computer Software, net

Computer software at December 31 is

summarized as follows:

(in thousands) 2012 2011

Licensed computer

software ................ $461,217 423,100

Software development

costs ................... 303,668 283,452

Acquisition technology

intangibles .............. 89,371 76,055

Total computer software ..... 854,256 782,607

Less accumulated

amortization:

Licensed computer

software ............... 336,521 309,571

Software development

costs ................. 232,113 208,781

Acquisition technology

intangibles ............ 58,705 49,011

Total accumulated

amortization ............. 627,339 567,363

Computer software, net ..... $226,917 215,244

The Company allocated approximately $13.0 million

to acquisition technology intangibles during 2012

due to the acquisitions of ProPay and CPAY. Refer to

Note 24 for more information on these acquisitions.

Amortization expense related to licensed computer

software costs was $37.4 million, $37.1 million and

$33.4 million for the years ended December 31,

2012, 2011 and 2010, respectively. Amortization

expense includes amounts for computer software

acquired under capital lease. Amortization of

42