NetSpend 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

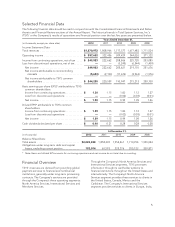

These efforts are already starting to show results; for although we

began 2012 with margins of 4.3 percent in the first quarter, we

finished with margins of 6.9 percent for the full year. In spite of the

economic turbulence in Europe, we did exceptionally well in 2012,

with our total transactions increasing by 17.4 percent. Our revenue

from this segment was $413.5 million, an increase of 4.7 percent

year over year. The International segment represents approximately

22 percent of TSYS’ consolidated revenue.

MERCHANT SERVICES:

On the merchant front, we will

continue to expand more in the direct merchant-acquiring business

through internally generated growth as well as acquisitions. We have

diversified our sales distribution model and introduced innovative

new products. We are focused on helping businesses operate more

efficiently. Today, more than half of the revenue within the Merchant

segment comes from our direct merchant-acquiring business. We

continue to look for acquisition opportunities inside and outside the

United States. Our revenue before reimbursables from this segment

was $409.7 million, an increase of 9.8 percent year over year. The

Merchant Services segment represents approximately 27 percent

of TSYS’ consolidated revenue.

ON GROWTH AND INNOVATION

While our performance is measured year over year, our growth

strategy is a five-year, forward-looking plan. For the enterprise,

our corporate strategy is to perfect and grow our issuing-solutions

business, expand our merchant-acquiring business, and become

a more innovative payment solutions provider.

Highlighting our focus on products and solutions, we have

introduced a business initiative that combines technology,

servicing and innovation. This foundational layer makes it easy

to launch future products as well as client- and customer-driven

solutions. Our experience, scale and trusted brand make us a

respected presence among traditional players and young,

entrepreneurial companies with an interest in payment-related

services. As such, TSYS is networking and engaging in active

dialogue with newcomers to provide an incubator of sorts to

help them test their new products with interested TSYS clients.

In order to accelerate growth, we’re also conducting our business

with the mindset of a careful investor. New players, new pricing

—

and those who challenge the status quo

—

all stand to influence the

payments industry and the future of money in general. Regardless

of what new developments unfold, we will continue to view our role

as the premier supporter of all of the parties within the payments

ecosystem. We know the payments business inside and out

—

its

complexities and the newest regulatory and compliance parameters.

As such, we will always look to join forces with partners to

challenge current thinking, while creating new paradigms to

address the needs of issuers, merchants and consumers.

PLANNING FOR THE FUTURE

I’d also like to thank the TSYS Board for its oversight and active

participation in the numerous committees that guide and direct our

business. We recently formed a new board committee focusing on

technology to assist in the oversight of TSYS’ management of risk

regarding technology, data security, disaster recovery and business

continuity. Reducing operational and business risk is a primary focus

for TSYS. By actively assessing business and strategic risks to existing

business models, we are ensuring that TSYS is aware and responsive

to changes that impact our company

—

both today and tomorrow.

The job of a good Board of Directors is to see that the right people

are running the business today

—

and to ensure that the company’s

next generation is ready to seamlessly take the reins at a moment’s

notice. We have the next generation of leaders in place and are

grooming their successors. They are as passionate about this

company as we were when it first went public in 1983

—

and as

we still are today.

I’d also like to recognize the dedicated service of Becky Yarbrough,

who will retire this April after more than 12 years of service on the

TSYS Board.

PEOPLE-CENTERED PAYMENTS

As has been the case for the past three decades, TSYS will focus

on putting people at the center of payments as we move forward.

And if the first 30 years are any indication, I’m sure the next chapters

of our story will be beyond our imaginations.

Our story started with people and is still centered around people

today. We are thankful that you continue to help us write it.

Sincerely,

Philip W. Tomlinson

Chairman of the Board

& Chief Executive Officer

3

LEFT: TSYS converts its first European client, Royal Bank of Scotland®

.

()

ABOVE: A ribbon-cutting ceremony at the Knaresborough, U.K., data

center symbolizes TSYS’ growth in the international card industry,

setting the stage for future worldwide expansion. ()