NetSpend 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Bulletin (SAB) No. 104, “Revenue Recognition” and

ASC 605, “Revenue Recognition.” The capitalization

of costs related to cash payments for rights to

provide processing services is capitalized in

accordance with the provisions of ASC 605. All costs

incurred prior to a signed agreement are expensed

as incurred.

Contract acquisition costs are amortized using the

straight-line method over the expected customer

relationship (contract term) beginning when the

client’s cardholder accounts are converted and

producing revenues. The amortization of contract

acquisition costs associated with cash payments for

client incentives is included as a reduction of

revenues in the Company’s Consolidated Statements

of Income. The amortization of contract acquisition

costs associated with conversion activity is recorded

as cost of services in the Company’s Consolidated

Statements of Income.

The Company evaluates the carrying value of contract

acquisition costs associated with each customer for

impairment on the basis of whether these costs are

fully recoverable from either contractual minimum

fees (contractual costs) or from expected

undiscounted net operating cash flows of the related

contract (cash incentives paid). The determination of

expected undiscounted net operating cash flows

requires management to make estimates. These costs

may become impaired with the loss of a contract, the

financial decline of a client, termination of conversion

efforts after a contract is signed, diminished

prospects for current clients or if the Company’s

actual results differ from its estimates of future cash

flows. The amount of the impairment is written off in

the period that such a determination is made.

EQUITY INVESTMENTS: TSYS’ 49% investment in

Total System Services de México, S.A. de C.V. (TSYS

de México), an electronic payment processing

support operation located in Toluca, Mexico, is

accounted for using the equity method of

accounting, as is TSYS’ 44.56% investment in China

UnionPay Data Co., Ltd. (CUP Data) headquartered in

Shanghai, China. TSYS’ equity investments are

recorded initially at cost and subsequently adjusted

for equity in earnings, cash contributions and

distributions, and foreign currency translation

adjustments.

GOODWILL: Goodwill results from the excess

of cost over the fair value of net assets of

businesses acquired.

Goodwill and intangible assets with indefinite useful

lives are tested for impairment at least annually in

accordance with the provisions of ASC 350. ASC 350

also requires that intangible assets with estimable

useful lives be amortized over their respective

estimated useful lives to their estimated residual

values.

The portion of the difference between the cost of an

investment and the amount of underlying equity in

net assets of an equity method investee that is

recognized as goodwill in accordance with the

provisions of ASC 323, “Investments — Equity

Method and Joint Ventures,” shall not be amortized.

However, equity method goodwill shall not be

reviewed for impairment in accordance with ASC 350,

but instead should continue to be reviewed for

impairment in accordance with paragraph 19(h) of

ASC 323. Equity method goodwill, which is not

reported as goodwill in the Company’s Consolidated

Balance Sheet, but is reported as a component of the

equity investment, was $51.3 million at December 31,

2012.

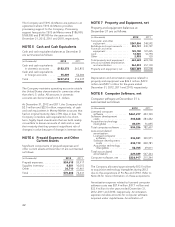

At December 31, 2012, the Company had goodwill in

the amount of $518.3 million. The Company

performed its annual impairment analyses of its

goodwill balance, and these tests did not indicate

any impairment for the periods ended December 31,

2012, 2011 and 2010, respectively.

OTHER INTANGIBLE ASSETS: Identifiable

intangible assets relate primarily to customer

relationships, channel relationships, covenants-not-

to-compete, trade names and trade associations

resulting from acquisitions. These identifiable

intangible assets are amortized using the straight-line

method over periods not exceeding the estimated

useful lives, which range from three to ten years.

ASC 350 requires that intangible assets with

estimable useful lives be amortized over their

respective estimated useful lives to their estimated

residual values, and reviewed for impairment in

accordance with ASC 360. Amortization expenses are

charged to selling, general and administrative

expenses in the Company’s Consolidated Statements

of Income.

FAIR VALUES OF FINANCIAL

INSTRUMENTS: The Company uses financial

instruments in the normal course of its business. The

carrying values of cash equivalents, accounts

receivable, accounts payable, accrued salaries and

employee benefits, and other current liabilities

approximate their fair value due to the short-term

34