NetSpend 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

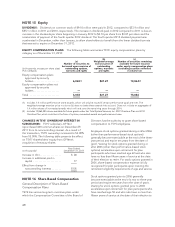

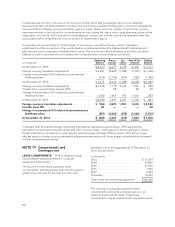

Comprehensive income is the sum of net income and other items that must bypass the income statement

because they have not been realized, including items such as an unrealized holding gain or loss from available for

sale securities and foreign currency translation gains or losses. These items are not part of net income, yet are

important enough to be included in comprehensive income, giving the user a more comprehensive picture of the

organization as a whole. Items included in comprehensive income, but not net income, are reported under the

accumulated other comprehensive income section of shareholders’ equity.

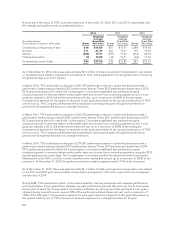

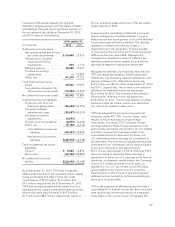

Comprehensive income (loss) for TSYS consists of net income, cumulative foreign currency translation

adjustments and the recognition of an overfunded or underfunded status of a defined benefit postretirement

plan recorded as a component of shareholders’ equity. The income tax effects allocated to and the cumulative

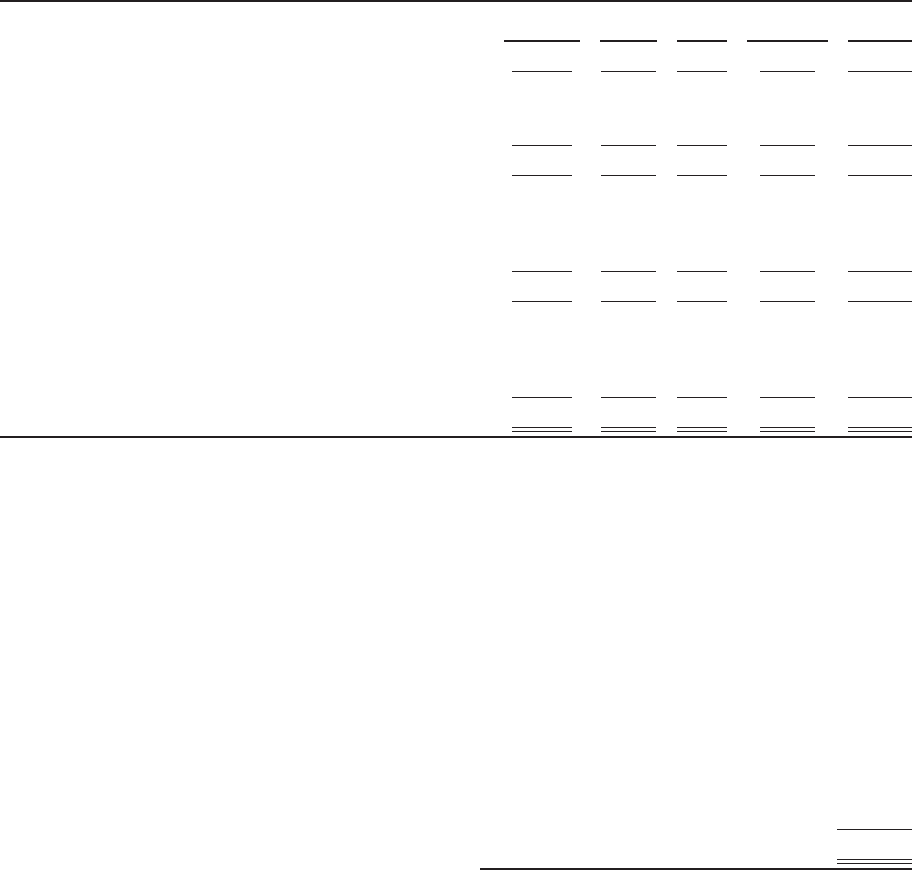

balance of each component of accumulated other comprehensive income (loss) are as follows:

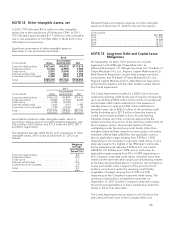

(in thousands) Beginning

Balance Pretax

amount Tax

effect Net-of-Tax

Amount Ending

Balance

At December 31, 2009 ............................... $(6,627) 14,375 2,075 12,300 $ 5,673

Foreign currency translation adjustments ................ $6,287 (8,609) (1,080) (7,529) $ (1,242)

Change in accumulated OCI related to postretirement

healthcare plans ................................... (614) (1,138) (409) (729) (1,343)

At December 31, 2010 ............................... $5,673 (9,747) (1,489) (8,258) $ (2,585)

Foreign currency translation adjustments ................ $(1,242) 3,718 2,662 1,056 $ (186)

Transfer from noncontrolling interest (NCI) ............... — 28 — 28 28

Change in accumulated OCI related to postretirement

healthcare plans ................................... (1,343) 1,651 595 1,056 (287)

At December 31, 2011 ............................... $(2,585) 5,397 3,257 2,140 $ (445)

Foreign currency translation adjustments .............. $ (186) 4,875 1,357 3,518 $ 3,332

Transfer from NCI .................................. 28 — — — 28

Change in accumulated OCI related to postretirement

healthcare plans .................................. (287) (2,603) (938) (1,665) (1,952)

At December 31, 2012 .............................. $ (445) 2,272 (419) 1,853 $ 1,408

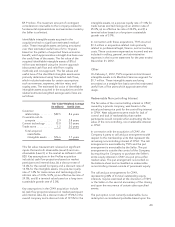

Consistent with its overall strategy of pursuing international investment opportunities, TSYS adopted the

permanent reinvestment exception under ASC 740, “Income Taxes,” with respect to future earnings of certain

foreign subsidiaries. Its decision to permanently reinvest foreign earnings offshore means TSYS will no longer

allocate taxes to foreign currency translation adjustments associated with these foreign subsidiaries accumulated

in other comprehensive income.

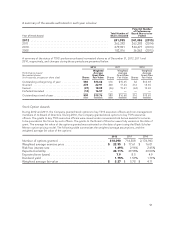

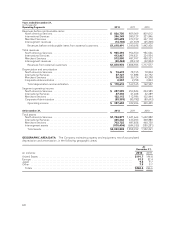

NOTE 19 Commitments and

Contingencies

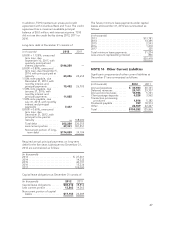

LEASE COMMITMENTS: TSYS is obligated under

noncancelable operating leases for computer

equipment and facilities.

The future minimum lease payments under

noncancelable operating leases with remaining terms

greater than one year for the next five years and

thereafter and in the aggregate as of December 31,

2012, are as follows:

(in thousands)

2013 ............................... $ 76,479

2014 ............................... 53,859

2015 ............................... 27,419

2016 ............................... 7,529

2017 ............................... 4,543

Thereafter .......................... 12,639

Total future minimum lease payments . . . $182,468

The majority of computer equipment lease

commitments come with a renewal option or an

option to terminate the lease. These lease

commitments may be replaced with new leases which

54