NetSpend 2012 Annual Report Download - page 69

Download and view the complete annual report

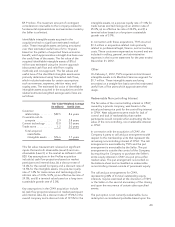

Please find page 69 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The fair value of the acquired identifiable intangible

assets of $100.8 million was estimated using the

income approach (discounted cash flow and relief

from royalty methods) and cost approach. At the time

of the acquisition, TSYS had identified certain

intangible assets that are expected to generate future

earnings for the Company: customer-related

intangible assets (such as customer lists), contract-

based intangible assets (such as referral agreements),

technology, and trademarks. The useful lives of the

identified intangible assets were primarily determined

by forecasted cash flows, which include estimates for

certain assumptions such as revenues, expenses,

attrition rates, and royalty rates. The useful lives of

these identified assets ranged from 3 to 10 years and

are being amortized on a straight-line basis based

upon their estimated pattern of economic benefit.

This fair value measurement is based on significant

inputs that are not observable in the market and thus

represents a Level 3 measurement as defined in

ASC 820. Key assumptions include (a) cash flow

projections based on market participant and internal

data, (b) a discount rate range of 4% to 14%, (c) a

royalty rate range of 1.5% to 7%, (d) an attrition rate

range of 10% to 30%, and (e) an effective tax rate of

approximately 36%.

The fair value of the noncontrolling interest in TMS,

owned by a private company, was estimated by

applying the income and market approaches. In

particular, a discounted cash flow method, a

guideline companies method, and a recent equity

transaction were employed. This fair value

measurement is based on significant inputs that are

both observable (Level 2) and non-observable

(Level 3) in the market as defined in ASC 820. Key

assumptions include (a) cash flow projections based

on market participant data and developed by

Company management, (b) a discount rate range of

12% to 14%, (c) a terminal value based on long-term

sustainable growth rates ranging between 3% and

5%, (d) an effective tax rate of approximately 36%,

(e) financial multiples of companies deemed to be

similar to TMS, and (f) adjustments because of the

lack of control or lack of marketability that market

participants would consider when estimating the fair

value of the noncontrolling interest in TMS.

With the acquisition of TMS on April 1, 2010, TSYS’

incremental revenue compared to the prior year

associated with acquisitions was $32.7 million and

$97.7 million for the years ended December 31, 2011

and 2010, respectively. For the years ended

December 31, 2011 and 2010, TSYS has included

approximately $4.2 million and $12.7 million,

respectively, in income netted against acquisition

related costs associated with TMS.

Pro forma Results of Operations

The pro forma revenue and earnings of TSYS’

acquisitions are not material to the consolidated

financial statements.

NOTE 25 Collaborative Arrangement

In January 2009, TSYS adopted the authoritative

guidance under ASC 808, “Collaborative

Arrangements.”

TSYS has a 45% ownership interest in an enterprise

jointly owned with two other entities which operates

aircraft for the owners’ internal use. The arrangement

allows each entity access to the aircraft and each

entity pays for its usage of the aircraft. Each quarter,

the net operating results of the enterprise are shared

among the owners based on their respective

ownership percentage.

TSYS records its usage of the aircraft and its share of

net operating results of the enterprise in selling,

general and administrative expenses.

66