NetSpend 2012 Annual Report Download - page 49

Download and view the complete annual report

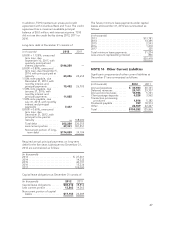

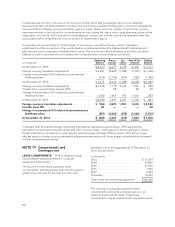

Please find page 49 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.borrowed in full at closing. The Company is required

to make quarterly principal payments on the term

loan commencing on December 31, 2012 equal to

(i) 1.25% of the original principal amount of the term

loan for the first 12 such quarterly payments and

(ii) 2.50% of the original principal amount of the term

loan for the remaining quarterly principal payments.

The Company is required to repay the entire

remaining principal balance of the term loan in full on

September 10, 2017. At the Company’s option, the

outstanding principal balance of the term loan will

bear interest at a rate equal to (i) LIBOR for U.S.

Dollars plus an applicable margin ranging from 1.00%

to 1.75% depending on the Company’s corporate

credit rating, or (ii) the base rate described above

plus an applicable margin ranging from 0% to 0.75%

depending on the Company’s corporate credit rating,

which is currently a “BBB+” investment grade rating

from Standard and Poors.

The Company may prepay loans made under the

revolving credit facility and the term loan in whole or in

part at any time without premium or penalty, subject to

reimbursement of the lenders’ customary breakage and

redeployment costs in the case of prepayment of

LIBOR borrowings. The Credit Agreement includes

covenants requiring the Company to maintain certain

minimum financial ratios and also contains certain

customary representations and warranties, affirmative

and negative covenants and provisions relating to

events of default and remedies.

The proceeds of the term loan were used to retire

indebtedness outstanding under the Company’s

previous credit facility. The Company may use

extensions of credit under the revolving credit facility

for working capital and other lawful corporate

purposes, including to finance the repurchase by the

Company of the Company’s capital stock.

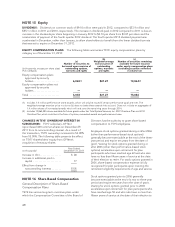

On September 10, 2012 and in connection with

entering into the credit facilities described above, the

Company terminated its existing credit agreement

dated as of December 21, 2007 with Bank of America

N.A., as Administrative Agent, The Royal Bank of

Scotland plc, as Syndication Agent, and the other

lenders named therein. That credit agreement

provided for a $252 million five-year unsecured

revolving credit facility and a $168 million five-year

term loan, both of which were scheduled to mature

on December 21, 2012. No material early termination

penalties were incurred as a result of the termination.

The Credit Agreement for the aforementioned loan

provided for a $168 million unsecured five year term

loan to the Company and a $252 million five year

unsecured revolving credit facility. The principal

balance of loans outstanding under the credit facility

had an interest at a rate of LIBOR plus an applicable

margin of 0.60%. The applicable margin could vary

within a range from 0.27% to 0.725% depending on

changes in the Company’s corporate credit rating.

Interest was paid on the last date of each interest

period; however, if the period exceeded three

months, interest was paid every three months after

the beginning of such interest period. In addition, the

Company is paid each lender a fee in respect of the

amount of such lender’s commitment under the

revolving credit facility (regardless of usage), ranging

from 0.08% to 0.15% (currently 0.10%) depending on

the Company’s corporate credit rating.

The Company was not required to make any

scheduled principal payments other than payment of

the entire outstanding balance on December 21,

2012. The Company was able to prepay the revolving

credit facility and the term loan in whole or in part at

any time without premium or penalty, subject to

reimbursement of the lenders’ customary breakage

and redeployment costs in the case of prepayment of

LIBOR borrowings. The Credit Agreement included

covenants requiring the Company to maintain certain

minimum financial ratios. The Company did not use

the revolving credit facility in 2012, 2011 or 2010.

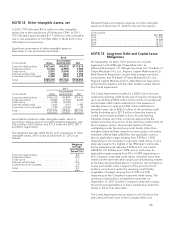

Due to increases in transaction volumes, TSYS

acquired additional mainframe software licenses to

increase capacity. The Company entered into an $8.6

million and an $11.9 million financing agreement in

June and December of 2012, respectively, to

purchase these additional software licenses.

In December 2010, the Company obtained a $39.8

million note payable from a third-party vendor

related to financing the purchase of distributed

systems software.

On October 30, 2008, the Company’s International

Services segment obtained a credit agreement from

a third-party to borrow up to approximately

¥2.0 billion, or $21 million, in a Yen-denominated

three-year loan to finance activities in Japan. The rate

is LIBOR plus 80 basis points. The Company initially

made a draw of ¥1.5 billion, or approximately

$15.1 million. In January 2009, the Company made

an additional draw down of ¥250 million, or

approximately $2.8 million. In April 2009, the

Company made an additional draw down of

¥250 million, or approximately $2.5 million. On

December 30, 2011, the Company modified its loan

to extend the maturity date to November 5, 2014.

46