NetSpend 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Company is subject to examinations by these taxing

authorities unless statutory examination periods

lapse. TSYS is no longer subject to U.S. federal

income tax examinations for years before 2008 and

with few exceptions, the Company is no longer

subject to income tax examinations from state and

local or foreign tax authorities for years before 2005.

There are currently federal income tax examinations

in progress for the years 2008 and 2009. Additionally,

a number of tax examinations are in progress by the

relevant state tax authorities. Although TSYS is

unable to determine the ultimate outcome of these

examinations, TSYS believes that its liability for

uncertain tax positions relating to these jurisdictions

for such years is adequate.

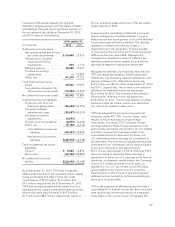

TSYS adopted the provisions of ASC 740 on

January 1, 2007 which prescribes a recognition

threshold and measurement attribute for the financial

statement recognition, measurement and disclosure

of a tax position taken or expected to be taken in a

tax return. During the year ended December 31,

2012, TSYS increased its liability for prior year

uncertain income tax positions as a discrete item by a

net amount of approximately $1.9 million (net of the

federal tax effect). This increase resulted from tax

positions taken on amended returns for the years

2008 and 2009. The Company is not able to

reasonably estimate the amount by which the liability

will increase or decrease over time; however, at this

time, the Company does not expect any significant

changes related to these obligations within the next

twelve months.

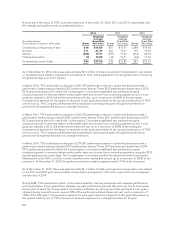

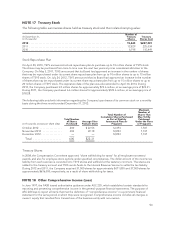

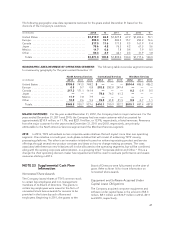

A reconciliation of the beginning and ending amount

of unrecognized tax liabilities is as follows (1):

(in millions)

Year Ended

December 31,

2012

Beginning balance ................ $ 5.7

Current activity:

Additions based on tax positions

related to current year ......... 1.4

Additions for tax positions of prior

years ........................ 2.0

Reductions for tax positions of prior

years ........................ (0.1)

Settlements .................... —

Net, current activity ........... 3.3

Ending balance ................... $ 9.0

(1) Unrecognized state tax liabilities are not adjusted for

the federal tax impact.

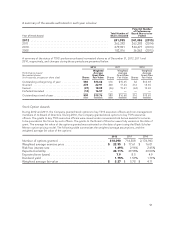

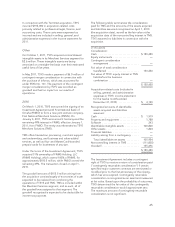

TSYS recognizes potential interest and penalties

related to the underpayment of income taxes as

income tax expense in the Consolidated Statements

of Income. Gross accrued interest and penalties on

unrecognized tax benefits totaled $0.9 million and

$0.6 million as of December 31, 2012 and

December 31, 2011, respectively. The total amounts

of unrecognized income tax benefits as of

December 31, 2012 and December 31, 2011 that, if

recognized, would affect the effective tax rates are

$8.8 million and $5.4 million (net of the federal

benefit on state tax issues), respectively, which

includes interest and penalties of $0.7 million and

$0.5 million, respectively.

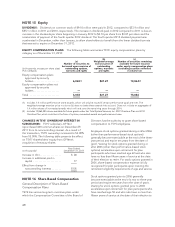

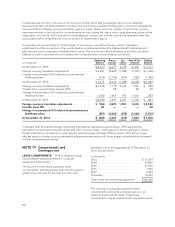

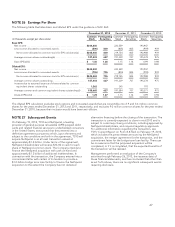

NOTE 21 Employee Benefit Plans

The Company provides benefits to its employees by

offering employees participation in certain defined

contribution plans. The employee benefit plans

through which TSYS provided benefits to its

employees during 2012 are described as follows:

TSYS RETIREMENT SAVINGS PLAN: Beginning in

2010, all qualified plans maintained by TSYS were

combined into a single plan, the Retirement Savings

Plan, which is designed to reward all team members

of TSYS U.S.—based companies with a uniform

employer contribution. The terms of the plan provide

for the Company to match 100% of the employee

contribution up to 4% of eligible compensation. The

Company can make discretionary contributions up to

another 4% based upon business conditions.

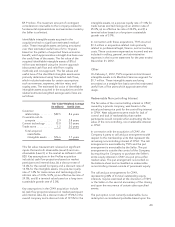

The Company’s contributions to the plan charged to

expense for the years ended December 31 are as

follows:

(in thousands) 2012 2011 2010

TSYS Retirement

Savings Plan . . . $13,421 15,951 15,430

STOCK PURCHASE PLAN: The Company

maintains a stock purchase plan for employees and

previously maintained a stock purchase plan for

directors. The Company contributes 15% of

employee contributions and contributed 15%

director voluntary contributions. The funds are used

to purchase presently issued and outstanding shares

of TSYS common stock on the open market at fair

market value for the benefit of participants. The

Director Stock Purchase Plan was terminated on

November 30, 2011. The Company’s contributions to

58