NetSpend 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 15 Equity

DIVIDENDS: Dividends on common stock of $94.0 million were paid in 2012, compared to $53.9 million and

$55.1 million in 2011 and 2010, respectively. The increase in dividends paid in 2012 compared to 2011 is due an

increase in the dividends per share beginning in January 2012 to $0.10 per share from $0.07 per share and the

acceleration of payment of the fourth quarter 2012 dividend. The fourth quarter 2012 dividend payment was

accelerated in December, rather than January, to allow shareholders to benefit from the lower dividend tax rate

that was set to expire on December 31, 2012.

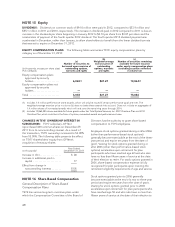

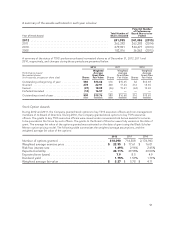

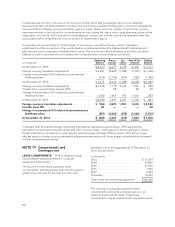

EQUITY COMPENSATION PLANS: The following table summarizes TSYS’ equity compensation plans by

category as of December 31, 2012:

(in thousands, except per share data)

Plan Category

(a)

Number of securities to

be issued upon exercise of

outstanding options,

warrants and rights

(b)

Weighted-average

exercise price of

outstanding

options, warrants

and rights

(c)

Number of securities remaining

available for future issuance

under equity compensation plans

(excluding securities reflected

in column (a))

Equity compensation plans

approved by security

holders ................... 6,065(1) $21.27 13,864(2)

Equity compensation plans not

approved by security

holders ................... —— —

Total ...................... 6,065 $21.27 13,864

(1) Includes 1.4 million performance share awards, which will only be issued if certain performance goals are met. The

weighted-average exercise price in column (b) does not take these awards into account. Does not include an aggregate of

1.4 million shares of nonvested awards which will vest over the remaining years through 2014.

(2) Includes 13,864,285 shares available for future grants under the Total System Services, Inc. 2007 Omnibus Plan and 2012

Omnibus Plan, which could be in the form of options, nonvested awards and performance shares.

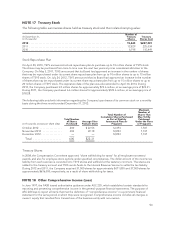

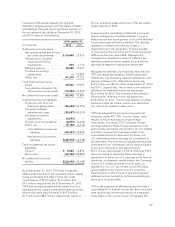

CHANGES IN TSYS’ OWNERSHIP INTEREST IN

SUBSIDIARIES: TSYS’ subsidiary, GP Net

repurchased 400 common shares on December 29,

2011 from its noncontrolling interest. As a result of

the transaction, TSYS’ ownership increased to 54.08%

from 53.00%. The following table presents the effect

on TSYS’ shareholders’ equity from GP Net’s

acquisition of treasury shares:

(in thousands) Year Ended

December 31, 2011

Increase in OCI ................ $ 28

Increase in additional paid in

capital ..................... 77

Effect from change in

noncontrolling interests ....... $105

NOTE 16 Share-Based Compensation

General Description of Share-Based

Compensation Plans

TSYS has various long-term incentive plans under

which the Compensation Committee of the Board of

Directors has the authority to grant share-based

compensation to TSYS employees.

Employee stock options granted during or after 2006

(other than performance-based stock options)

generally become exercisable at the end of the three-

year period and expire ten years from the date of

grant. Vesting for stock options granted during or

after 2006 (other than performance-based stock

options) accelerates upon retirement for plan

participants who have reached age 62 and who also

have no less than fifteen years of service at the date

of their election to retire. For stock options granted in

2006, share-based compensation expense is fully

recognized for plan participants upon meeting the

retirement eligibility requirements of age and service.

Stock options granted prior to 2006 generally

become exercisable at the end of a two to three-year

period and expire ten years from the date of grant.

Vesting for stock options granted prior to 2006

accelerates upon retirement for plan participants who

have reached age 50 and who also have no less than

fifteen years of service at the date of their election to

48