NetSpend 2012 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

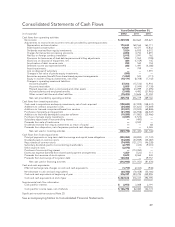

Cash Flows from Financing Activities

Years Ended December 31,

(in thousands) 2012 2011 2010

Principal payments

on long-term debt

borrowings and

capital lease

obligations ....... $(200,052) (28,892) (11,741)

Dividends paid on

common stock .... (94,035) (53,949) (55,087)

Repurchases of

common stock .... (74,939) (121,271) (46,228)

Subsidiary dividends

paid to

noncontrolling

shareholders ...... (2,797) (433) (9,031)

Purchase of

noncontrolling

interests .......... —(174,050) —

Proceeds from

borrowings of

long-term debt .... 150,000 — 39,757

Other .............. 8,858 7,542 654

Net cash used in

financing

activities ......... $(212,965) (371,053) (81,676)

The major uses of cash for financing activities have

been the principal payment on long term debt and

capital lease obligations, purchase of noncontrolling

interests, payment of dividends and the purchase of

stock under the stock repurchase plan as described

below. The main source of cash from financing

activities has been the use of borrowed funds. Net

cash used in financing activities for the year ended

December 31, 2012 was $213.0 million and was

primarily the result of principal payments on long-

term debt borrowings and capital lease obligations,

payment of dividends and the repurchase of common

stock offset by proceeds from borrowings of long-

term debt. Net cash used in financing activities for

the year ended December 31, 2011 was $371.1

million and was primarily the result of the acquisition

of the remaining 49% interest in TMS, payment of

dividends and the repurchase of common stock. The

Company used $81.7 million in cash for financing

activities for the year ended December 31, 2010

primarily for payments on long-term debt and capital

lease obligations and the payments of cash

dividends. Refer to Note 13 in the consolidated

financial statements for more information on the

long-term debt financing.

Financing

In September 2012, TSYS obtained a $150.0 million

note payable from a third party vendor to pay off

existing long term notes.

In December 2010, TSYS obtained a $39.8 million

note payable from a third-party vendor related to

financing the purchase of distributed systems

software.

On October 30, 2008, the Company’s International

Services segment obtained a credit agreement from

a third-party to borrow up to approximately

¥2.0 billion, or $21 million, in a Yen-denominated

three-year loan to finance activities in Japan. The rate

is the LIBOR plus 80 basis points. The Company

initially made a draw of ¥1.5 billion, or approximately

$15.1 million. In January 2009, the Company made

an additional draw down of ¥250 million, or

approximately $2.8 million. In April 2009, the

Company made an additional draw down of

¥250 million, or approximately $2.5 million. On

December 3, 2011, the Company modified its loan to

extend the maturity date to November 5, 2014.

Refer to Note 13 in the consolidated financial

statements for further information on TSYS’ long-term

debt and financing arrangements.

Purchase of Noncontrolling Interest

With the acquisition of TMS, the Company was a

party to put and call arrangements with respect to

the membership units that represented the remaining

noncontrolling interest of FNMS Holding, LLC (FNMS

Holding). The call and put arrangements could have

been exercised at the discretion of TSYS or First

National Bank of Omaha (FNBO) on April 1, 2015,

2016 and 2017, upon the dilution of FNBO’s equity

ownership in FNMS Holding below a designated

threshold and in connection with certain acquisitions

by TSYS or FNMS Holding in excess of designated

value thresholds.

On January 4, 2011, TSYS announced that it

acquired, effective January 1, 2011, the remaining

49% interest in TMS from FNBO. The fair value of the

noncontrolling interest in TMS, owned by a private

company at December 31, 2010, was estimated by

applying the income and market approaches. In

particular, a discounted cash flow method, a

guideline companies method, and a recent equity

transaction were employed. This fair value

20