NetSpend 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

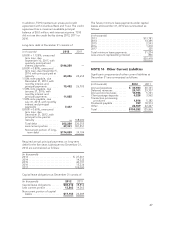

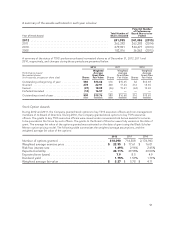

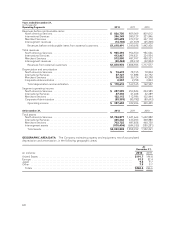

Temporary differences between the financial

statement carrying amounts and tax bases of assets

and liabilities that give rise to significant portions of

the net deferred tax liability at December 31, 2012

and 2011 relate to the following:

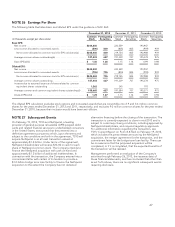

At December 31,

(in thousands) 2012 2011

Deferred income tax assets:

Net operating loss and income

tax credit carryforwards .....$ 24,405 25,937

Allowances for doubtful

accounts and billing

adjustments ............... 644 1,113

Deferred revenue ............ 18,645 19,031

Purchase accounting

adjustments ............... —15,889

Other, net .................. 41,348 37,123

Total deferred income tax

assets ...................... 85,042 99,093

Less valuation allowance for

deferred income tax assets . . (19,400) (19,207)

Net deferred income tax assets . . 65,642 79,886

Deferred income tax liabilities:

Excess tax over financial

statement depreciation ..... (36,682) (42,351)

Computer software

development costs ......... (39,637) (40,339)

Purchase accounting

adjustments ............... (4,514) —

Foreign currency translation . . . (8,574) (6,432)

Other, net .................. (9,150) (6,712)

Total deferred income tax

liabilities ................ (98,557) (95,834)

Net deferred income tax

liabilities ................$(32,915) (15,948)

Total net deferred tax assets

(liabilities): ..................

Current .....................$ 9,825 12,872

Noncurrent ................. (42,740) (28,820)

Net deferred income tax

liability .....................$(32,915) (15,948)

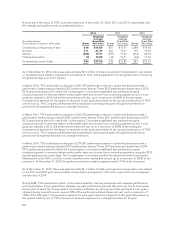

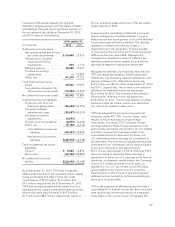

As of December 31, 2012, TSYS had recognized

deferred tax assets from net operating losses, capital

losses and federal and state income tax credit

carryforwards of $13.4 million, $1.9 million and

$9.1 million, respectively. As of December 31, 2011,

TSYS had recognized deferred tax assets from net

operating losses, capital losses and federal and state

income tax credit carry forwards of $15.5 million,

$1.9 million and $8.5 million, respectively. Some of

the net operating losses and some of the tax credits

began expiring in 2012.

In assessing the realizability of deferred income tax

assets, management considers whether it is more

likely than not that some portion or all of the deferred

income tax assets will not be realized. The ultimate

realization of deferred income tax assets is

dependent upon the generation of future taxable

income during the periods in which those temporary

differences become deductible. Management

considers the scheduled reversal of deferred tax

liabilities, projected future taxable income and tax

planning strategies in making this assessment.

Management believes it is more likely than not that

TSYS will realize the benefits of these deductible

differences, net of existing valuation allowances. The

valuation allowance for deferred tax assets was

$19.4 million and $19.2 million at December 31, 2012

and 2011, respectively. The increase in the valuation

allowance for deferred income tax assets was

$0.2 million for 2012. The increase in the valuation

allowance for deferred income tax assets was

$3.8 million for 2011. The increase relates to foreign

losses and state tax credits, which more likely than

not, will not be realized in later years.

TSYS has adopted the permanent reinvestment

exception under ASC 740, “Income Taxes,” with

respect to future earnings of certain foreign

subsidiaries. As a result, TSYS considers foreign

earnings related to these foreign operations to be

permanently reinvested. No provision for U.S. federal

and state incomes taxes has been made in our

consolidated financial statements for those non-

U.S. subsidiaries whose earnings are considered to

be reinvested. The amount of undistributed earnings

considered to be “reinvested” which may be subject

to tax upon distribution was approximately

$70.1 million at December 31, 2012. Although TSYS

does not intend to repatriate these earnings, a

distribution of these non-U.S. earnings in the form of

dividends, or otherwise, would subject the Company

to both U.S. federal and state income taxes, as

adjusted for non-U.S. tax credits, and withholding

taxes payable to the various non-U.S. countries.

Determination of the amount of any unrecognized

deferred income tax liability on these undistributed

earnings is not practicable.

TSYS is the parent of an affiliated group that files a

consolidated U.S. federal income tax return and most

state and foreign income tax returns on a separate

entity basis. In the normal course of business, the

57