NetSpend 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

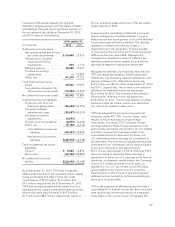

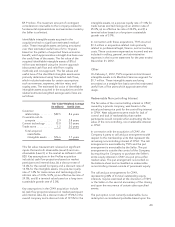

PRIVATE EQUITY INVESTMENTS: On May 31,

2011, the Company entered into a limited

partnership agreement in connection with its

agreement to invest in an Atlanta-based venture

capital fund focused exclusively on investing in

technology-enabled financial services companies.

Pursuant to the limited partnership agreement, the

Company has committed to invest up to $20 million

in the fund so long as its ownership interest in the

fund does not exceed 50%. At December 31, 2012,

the Company had made investments in the fund of

$4.6 million and recognized a gain of $898,000 due

to an increase in fair value.

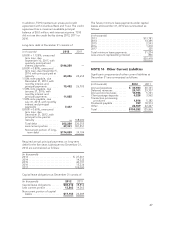

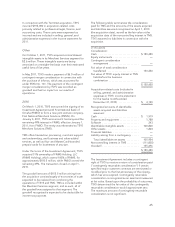

NOTE 20 Income Taxes

The provision for income taxes includes income taxes

currently payable and those deferred because of

temporary differences between the financial statement

carrying amounts and tax bases of assets and liabilities.

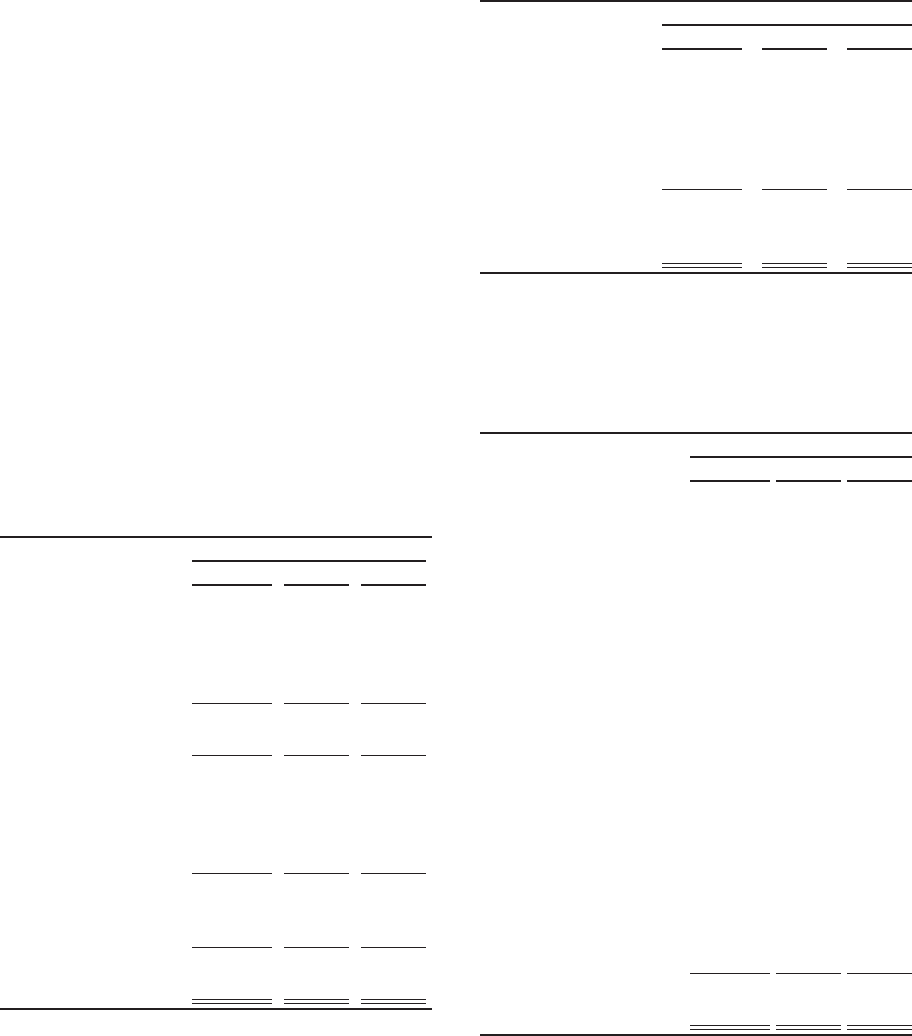

The components of income tax expense included in the

Consolidated Statements of Income were as follows:

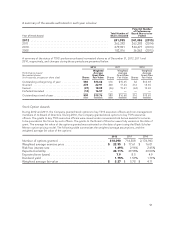

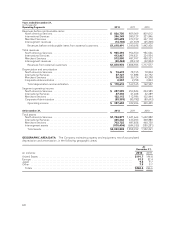

Years Ended December 31,

(in thousands) 2012 2011 2010

Current income tax

expense:

Federal ...........$ 98,153 83,518 98,802

State ............. 2,572 4,666 4,221

Foreign ........... 14,092 12,922 8,682

Total current income

tax expense ....... 114,817 101,106 111,705

Deferred income tax

expense (benefit):

Federal ........... 1,395 3,126 (2,970)

State ............. 411 61 (643)

Foreign ........... (1,521) (1,696) (2,004)

Total deferred income

tax expense

(benefit) .......... 285 1,491 (5,617)

Total income tax

expense ..........$115,102 102,597 106,088

Years Ended December 31,

(in thousands) 2012 2011 2010

Components of

income before

income tax

expense :

Domestic ..... $320,581 279,416 286,490

Foreign ...... 34,273 37,135 21,322

Total income

before income

tax expense .... $354,854 316,551 307,812

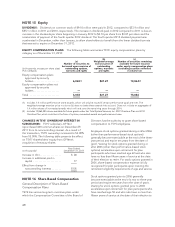

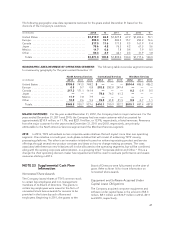

Income tax expense differed from the amounts

computed by applying the statutory U.S. federal

income tax rate of 35% to income before income

taxes, noncontrolling interest and equity in income of

equity investments as a result of the following:

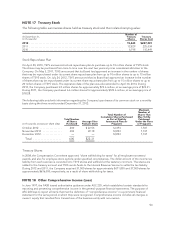

Years Ended December 31,

(in thousands) 2012 2011 2010

Computed “expected”

income tax expense . . $124,199 110,793 107,734

Increase (decrease) in

income tax expense

resulting from:

International tax rate

differential ...... 2,781 1,831 (4,376)

State income tax

expense (benefit),

net of federal

income tax

effect ........... 2,143 3,164 2,326

Increase in valuation

allowance ....... 193 3,773 2,564

Tax credits ........ (3,762) (9,044) (2,824)

Deduction for

domestic

production

activities ........ (5,727) (5,524) —

Permanent

differences and

other, net ....... (4,725) (2,396) 664

Total income tax

expense ............$115,102 102,597 106,088

56