NetSpend 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Level 2 — Observable inputs other than quoted

prices included in Level 1, such as quoted prices for

similar assets and liabilities in active markets, quoted

prices for identical or similar assets and liabilities in

markets that are not active, or other inputs that are

observable or can be corroborated by observable

market data.

Level 3 — Unobservable inputs for the asset or

liability.

Goodwill and certain intangible assets not subject to

amortization are assessed annually for impairment in

the second quarter of each year using fair value

measurement techniques. Specifically, goodwill

impairment is determined using a two-step test. The

first step of the goodwill impairment test is used to

identify potential impairment by comparing the fair

value of a reporting unit (RU) with its book value,

including goodwill. If the fair value of the RU exceeds

its book value, goodwill is considered not impaired

and the second step of the impairment test is

unnecessary. If the book value of the RU exceeds its

fair value, the second step of the goodwill

impairment test is performed to measure the amount

of impairment loss, if any. The second step of the

goodwill impairment test compares the implied fair

value of the RU’s goodwill with the book value of that

goodwill. If the book value of the RU’s goodwill

exceeds the implied fair value of that goodwill, an

impairment loss is recognized in an amount equal to

that excess. The fair value of the RU is allocated to all

of the assets and liabilities of that unit as if the RU

had been acquired in a business combination and the

fair value of the RU was the purchase price paid to

acquire the RU.

The estimate of fair value of the Company’s RUs is

determined using various valuation techniques,

including using an equally weighted combination of

the market approach and the income approach. The

market approach, which contains Level 2 inputs,

utilizes readily available market valuation multiples to

estimate fair value. The income approach is a

valuation technique that utilizes the discounted cash

flow (DCF) method, which includes Level 3 inputs.

Under the DCF method, the fair value of the RU

reflects the present value of the projected earnings

that will be generated by each RU after taking into

account the revenues and expenses associated with

the asset, the relative risk that the cash flows will

occur, the contribution of other assets, and an

appropriate discount rate to reflect the value of the

invested capital. Cash flows are estimated for future

periods based upon historical data and projections

by management.

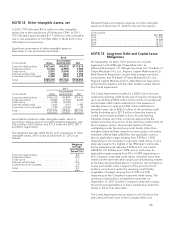

At December 31, 2012, the Company had recorded

goodwill in the amount of $518.3 million. The

Company performed its annual impairment test of its

unamortized goodwill balance as of May 31, 2012,

and these tests did not indicate any impairment. The

fair value of the RUs substantially exceeds the

carrying value. Refer to Note 10 for more information

regarding goodwill.

At December 31, 2012, the fair value of the

Company’s private equity investment was $5.5 million

based on Level 3 inputs. Refer to Note 19 for more

information regarding this investment.

The fair value of the Company’s long-term debt and

obligations under capital leases is not significantly

different from its carrying value.

NOTE 4 Relationships with Affiliated

Companies

The Company provides electronic payment

processing and other services to the Company’s

equity investments, TSYS de México and CUP Data.

The foregoing related party services are performed

under contracts that are similar to its contracts with

unrelated third party customers. The Company

believes the terms and conditions of transactions

between the Company and these related parties are

comparable to those which could have been

obtained in transactions with unaffiliated parties.

Through its related party transactions, TSYS

generates accounts receivable and liability accounts

with TSYS de México and CUP Data. The Company

had an accounts receivable balance of $7,500 and

$9,700 associated with related parties at

December 31, 2012 and 2011, respectively. The

Company had an accounts payable balance of

$77,000 and $32,400 with related parties at

December 31, 2012 and 2011, respectively.

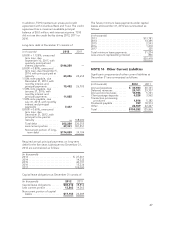

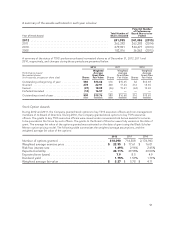

The table below details revenues derived from

affiliated companies for the years ended

December 31, 2012, 2011 and 2010:

(in thousands) 2012 2011 2010

Total revenues:

CUP Data ................. $172 136 130

TSYS de México ........... 72 62 51

Total revenues .............. $244 198 181

41