NetSpend 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

challenge by various taxing authorities. Contingency

reserves are periodically established where the

amount of the contingency can be reasonably

determined and is likely to occur. Reductions in

contingency reserves are recognized when tax

disputes are settled or examination periods lapse.

Significant estimates used in accounting for income

taxes relate to the determination of taxable income,

the determination of temporary differences between

book and tax basis, as well as estimates on the

realizability of tax credits and net operating losses.

TSYS recognizes potential interest and penalties

related to the underpayment of income taxes as

income tax expense in the Consolidated Statements

of Income.

EARNINGS PER SHARE: In June 2008, the FASB

issued authoritative guidance under ASC 260,

“Earnings Per Share.” The guidance under ASC 260

holds that unvested share-based payment awards

that contain nonforfeitable rights to dividends or

dividend equivalents are “participating securities” as

defined in ASC 260, and therefore should be

included in EPS using the two-class method.

The two-class method is an earnings allocation

method for computing EPS when an entity’s capital

structure includes two or more classes of common

stock or common stock and participating securities. It

determines EPS based on dividends declared on

common stock and participating securities and

participation rights of participating securities in any

undistributed earnings.

Basic EPS is calculated by dividing net income by the

weighted average number of common shares

outstanding during the period. Diluted EPS is

calculated to reflect the potential dilution that would

occur if stock options or other contracts to issue

common stock were exercised. Diluted EPS is

calculated by dividing net income by weighted

average common and common equivalent shares

outstanding. Common equivalent shares are

calculated using the treasury stock method.

RECLASSIFICATIONS: Certain reclassifications

have been made to the 2011 and 2010 financial

statements to conform to the presentation adopted

in 2012.

NOTE 2 Discontinued Operations

The Company sold certain assets and liabilities of

TPOS on September 30, 2010. The sale of certain

assets and liabilities of TPOS was the result of

management’s decision during the third quarter of

2010 to divest non-strategic businesses and focus

resources on core products and services. The

Company had a pre-tax goodwill impairment of

$2.2 million (approximately $1.5 million after-tax)

related to TPOS, which was included in discontinued

operations as part of the sale. This transaction

resulted in the assumed lease of its Sacramento,

California, facility and the closure of its Columbus,

Georgia-based distribution center.

TSYS will continue to use the buyer in a referral

arrangement for customers who approach the

Company for terminal services but will not have

significant continuing involvement after the sale to

the buyer.

TPOS was neither a significant component of the

Merchant Services segment, nor TSYS’ consolidated

results.

In accordance with the provisions of ASC 205, the

Company determined the TPOS business became a

discontinued operation in the third quarter of 2010.

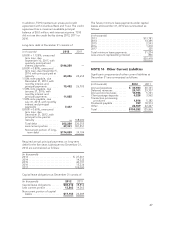

The following table presents the summarized results

of discontinued operations for the year ended

December 31, 2010:

(in thousands) 2010

Total revenues ........................ $ 7,430

Operating loss ........................ $(1,840)

Income taxes ......................... $ (621)

Loss from discontinued operations, net of

tax ................................ $(1,243)

Loss on disposition, net of tax ........... $(2,002)

The Consolidated Statements of Cash Flows include

TPOS through the respective date of disposition.

NOTE 3 Fair Value Measurement

ASC 820, “Fair Value Measurements and Disclosure,”

requires disclosure about how fair value is

determined for assets and liabilities and establishes a

hierarchy for which these assets and liabilities must

be grouped, based on significant level of inputs. The

three-tier fair value hierarchy, which prioritizes the

inputs used in the valuation methodologies, is as

follows:

Level 1 — Quoted prices for identical assets and

liabilities in active markets.

40