NetSpend 2012 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

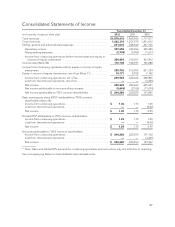

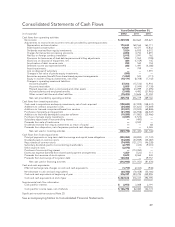

Cash Flows from Investing Activities

Years Ended December 31,

(in thousands) 2012 2011 2010

Cash used in

acquisitions and

equity

investments, net of

cash acquired .... $(188,698) (47,909) (148,531)

Additions to contract

acquisition

costs ........... (34,384) (31,623) (75,669)

Additions to licensed

computer software

from vendors .... (33,001) (19,502) (69,826)

Purchases of

property and

equipment, net . . . (31,395) (26,938) (46,547)

Additions to

internally

developed

computer

software ........ (19,285) (17,882) (25,466)

Other ............. (3,031) 2,434 4,333

Net cash used in

investing

activities ........ $(309,794) (141,420) (361,706)

The major uses of cash for investing activities in 2012,

2011 and 2010 were for acquisitions, additions to

contract acquisition costs, equipment, licensed

computer software from vendors and internally

developed computer software.

Cash Used in Acquisitions

In 2012, the Company used cash of $188.7 million in

the acquisitions of ProPay Inc. (ProPay) and CPAY. In

2011, the Company used cash of $42.0 million in the

acquisition of TermNet. In 2010, the Company

acquired TMS for an aggregate consideration of

approximately $150.5 million. Refer to Note 24 in the

consolidated financial statements for more

information on these acquisitions.

In May 2011, TSYS made a payment of $6.0 million of

contingent merger consideration in connection with

the purchase of Infonox on the Web, which was

recorded as goodwill.

Contract Acquisition Costs

TSYS makes cash payments for processing rights,

third-party development costs and other direct

salary-related costs in connection with converting

new customers to the Company’s processing

systems. The Company’s investments in contract

acquisition costs were $34.4 million in 2012,

$31.6 million in 2011 and $75.7 million in 2010. The

Company made cash payments for processing rights

of $14.4 million, $5.2 million and $45.4 million in

2012, 2011 and 2010, respectively. Conversion cost

additions were $20.0 million, $26.4 million and

$30.3 million in 2012, 2011 and 2010, respectively.

Property and Equipment

Capital expenditures for property and equipment

were $31.4 million in 2012, compared to $26.9

million in 2011 and $46.5 million in 2010. The

majority of capital expenditures in 2012, 2011 and

2010 related to investments in new computer

processing hardware.

Licensed Computer Software from Vendors

Expenditures for licensed computer software from

vendors for increases in processing capacity were

$33.0 million in 2012, compared to $19.5 million in

2011 and $69.8 million in 2010.

Internally Developed Computer Software Costs

Additions to capitalized software development costs,

including enhancements to and development of

processing systems, were $19.3 million in 2012,

$17.9 million in 2011, and $25.5 million in 2010.

Purchase of Private Equity Investments

On May 31, 2011, the Company entered into a

limited partnership agreement in connection with its

agreement to invest in an Atlanta-based venture

capital fund focused exclusively on investing in

technology-enabled financial services companies.

Pursuant to the limited partnership agreement, the

Company has committed to invest up to $20 million

in the fund so long as its ownership interest in the

fund does not exceed 50%. The Company made

investments in the fund of $3.0 million and

$1.6 million in 2012 and 2011, respectively. The

Company recorded a gain on this investment of

$898,000 for the year ended December 31, 2012.

19