NetSpend 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

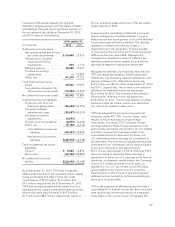

passage of time of the second anniversary date. As

such, the Company has adopted the accounting

policy to accrete changes in the redemption value

over the period from the date of issuance to the

earliest redemption date, which the Company

believes to be two years. If the put option was

currently redeemable, the redemption value at

December 31, 2012 is estimated to be approximately

$39.5 million. The Company did not accrete any

changes to the redemption value as the balance at

December 31, 2012 exceeded the accretion fair value

amount.

2011

On May 2, 2011, TSYS completed its acquisition of all

of the outstanding common stock of TermNet, an

Atlanta-based merchant acquirer, for $42 million in

cash. TermNet provides merchant services to

qualified merchants serving a diverse merchant base

of over 18,000 merchants. The acquisition of

TermNet expands the Company’s presence in the

merchant acquiring industry. The results of

operations for TermNet have been included in the

Company’s results beginning May 2, 2011, and are

included in the Merchant Services segment. The

goodwill of $28.9 million recorded arises largely from

synergies and economies of scale expected to be

realized from combining the operations of TSYS and

TermNet. Goodwill recognized in the acquisition of

TermNet is not deductible for income tax purposes.

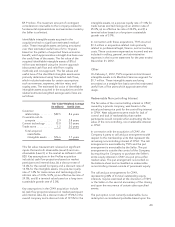

The following table summarizes the consideration

paid for TermNet and the recognized amounts of

identifiable assets acquired and liabilities assumed

effective May 2, 2011:

(in thousands)

Cash and restricted cash ............... $ 2,691

Accounts receivable, net ............... 10,253

Other assets ......................... 1,516

Identifiable intangible assets ............ 11,740

Goodwill ............................ 28,918

Accounts payable ..................... (5,578)

Accrued compensation ................. (2,683)

Deferred income tax liability ............ (4,506)

Other liabilities ....................... (351)

Total consideration .................. $42,000

The fair value of accounts receivable, accounts

payable, accrued compensation, and other liabilities

approximates the carrying amount of those assets

and liabilities at the acquisition date. The fair value of

accounts receivable due under agreements with

customers is $10.3 million. The gross amount due

under the agreements is $10.4 million, of which

approximately $100,000 is expected to be

uncollectible. Of the $42 million in consideration paid

for TermNet, $8.4 million was placed in escrow for a

period of 18 months to secure certain claims brought

against the escrowed consideration by TSYS pursuant

to the merger agreement. The maximum amount of

contingent consideration returnable to the Company

related to fundamental representations and

warranties made by TermNet is unlimited.

Identifiable intangible assets acquired in the TermNet

acquisition include customer relationships, channel

relationships, and non-compete agreements. The

identifiable intangible assets had no significant

estimated residual value. These intangible assets are

being amortized over their estimated useful lives of 2

to 10 years based on the pattern of expected future

economic benefit, which approximates a straight-line

basis over the useful lives of the assets. The fair value

of the acquired identifiable intangible assets of $11.7

million was estimated using the income approach

(discounted cash flow and relief from royalty

methods) and cost approach. The fair values and

useful lives of the identified intangible assets were

primarily determined using forecasted cash flows,

which included estimates for certain assumptions

such as revenues, expenses, attrition rates, and

royalty rates. The estimated fair value of identifiable

intangible assets acquired in the acquisition of

TermNet and the related estimated weighted

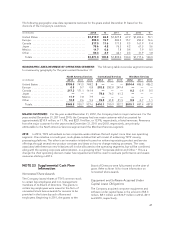

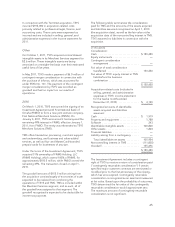

average useful lives are as follows:

Fair Value

(in millions)

Weighted Average

Useful Lives

Customer

relationships ........ $10.0 7.0 years

Channel relationships . . 1.6 10.0 years

Covenants-not-to-

compete ........... 0.1 2.0years

Total acquired

identifiable

intangible assets . . . $11.7 7.3 years

The fair value measurement of the identifiable

intangible assets is based on significant inputs that are

not observable in the market and therefore,

represents a Level 3 measurement as defined in ASC

820. Key assumptions include (a) cash flow projections

based on market participant and internal data, (b) a

discount rate of 14%, (c) a pre-tax royalty rate range of

3-10%, (d) an attrition rate of 20%, (e) an effective tax

rate of 36%, and (f) a terminal value based on a long-

term sustainable growth rate of 3%.

64