NetSpend 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

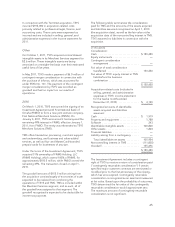

Management’s Report on Internal Control Over Financial

Reporting

The management of Total System Services, Inc. (the Company) is responsible for establishing and maintaining

adequate internal control over financial reporting as defined in Rule 13a-15(f) under the Securities Exchange Act

of 1934. The Company maintains accounting and internal control systems which are intended to provide

reasonable assurance that assets are safeguarded against loss from unauthorized use or disposition, transactions

are executed in accordance with management’s authorization and accounting records are reliable for preparing

financial statements in accordance with accounting principles generally accepted in the United States.

Internal control over financial reporting cannot provide absolute assurance of achieving financial reporting

objectives because of its inherent limitations. Internal control over financial reporting is a process that involves

human diligence and compliance and is subject to lapses in judgment and breakdowns resulting from human

failures. Internal control over financial reporting also can be circumvented by collusion or improper management

override. Because of such limitations, there is a risk that material misstatements may not be prevented or

detected on a timely basis by internal control over financial reporting. However, these inherent limitations are

known features of the financial reporting process. Therefore, it is possible to design into the process safeguards

to reduce, though not eliminate, risk.

The Company’s management assessed the effectiveness of the Company’s internal control over financial

reporting as of December 31, 2012. In making this assessment, management used the criteria set forth by the

Committee of Sponsoring Organizations (COSO) of the Treadway Commission in Internal Control — Integrated

Framework.

Based on our assessment management believes that, as of December 31, 2012, the Company’s internal control

over financial reporting is effective based on those criteria.

KPMG LLP, the independent registered public accounting firm who audited the Company’s consolidated financial

statements, has issued an attestation report on the effectiveness of internal control over financial reporting as of

December 31, 2012 that appears on the preceding page.

Philip W. Tomlinson

Chairman of the Board &

Chief Executive Officer

James B. Lipham

Senior Executive Vice President &

Chief Financial Officer

69