NetSpend 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

earnings through fee reductions, higher costs (both

regulatory and implementation) and new restrictions

on our operations. The Financial Reform Act may also

impact the competitive dynamics of the financial

services industry in the U.S. by more adversely

impacting large financial institutions, some of which

are TSYS clients, and by adversely impacting the

competitive position of U.S. financial institutions in

comparison to foreign competitors in certain

businesses.

The Financial Reform Act, which includes the Durbin

Amendment to the Electronic Funds Transfer Act,

mandates that the Federal Reserve Board limit debit

card interchange fees. Final rules were issued in June

2011. The final rules cap interchange fees for debit

transactions at $0.21 plus five basis points of the

transaction and require that the amount of any debit

interchange transaction fee charged be reasonable

and proportional to the costs incurred in connection

with the transaction.

Although this legislative action by the U.S. Congress

had been anticipated for some time, it remains

impossible to predict the impact, if any, that the law

and the regulations to be promulgated thereunder

may have on the Company’s operations or its

financial condition in the future. However, as TSYS’

business is predominately credit card related, the

Durbin Amendment is not expected to have a

significant negative impact upon TSYS’ business.

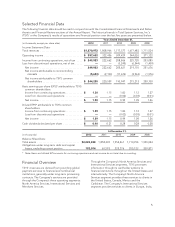

Financial Review

This Financial Review provides a discussion of critical

accounting policies and estimates, related party

transactions and off-balance sheet arrangements.

This Financial Review also discusses the results of

operations, financial position, liquidity, and capital

resources of TSYS and outlines the factors that have

affected its recent earnings, as well as those factors

that may affect its future earnings. The accompanying

Consolidated Financial Statements and related Notes

are an integral part of this Financial Review and

should be read in conjunction with it.

Critical Accounting Policies and Estimates

TSYS’ financial position, results of operations and

cash flows are impacted by the accounting policies

the Company has adopted. In order to gain a full

understanding of the Company’s financial statements,

one must have a clear understanding of the

accounting policies employed.

Refer to Note 1 in the consolidated financial

statements for more information on the Company’s

basis of presentation and a summary of significant

accounting policies.

Risk factors that could affect the Company’s future

operating results and cause actual results to vary

materially from expectations are listed in the

Company’s forward-looking statements. Negative

developments in these or other risk factors could

have a material adverse effect on the Company’s

financial position, results of operations and cash

flows.

Management believes that the following accounting

policies are the most critical to fully understand and

evaluate the Company’s results. Within each critical

policy, the Company makes estimates that require

management’s subjective or complex judgments

about the effects of matters that are inherently

uncertain.

A summary of the Company’s critical accounting

estimates applicable to all three reportable operating

segments follows:

Allowance for Doubtful Accounts and

Billing Adjustments

The Company estimates the allowances for doubtful

accounts. When estimating the allowances for

doubtful accounts, the Company takes into

consideration such factors as its knowledge of the

financial position of specific clients, the industry and

size of its clients, the overall composition of its

accounts receivable aging, prior experience with

specific customers of accounts receivable write-offs

and prior history of allowances in proportion to the

overall receivable balance. This analysis includes an

ongoing and continuous communication with its

largest clients and those clients with past due

balances. A financial decline of any one of the

Company’s large clients could have a material

adverse effect on collectability of receivables and

thus the adequacy of the allowance for doubtful

accounts. If the actual collectability of clients’

accounts is not consistent with the Company’s

estimates, bad debt expense, which is recorded in

selling, general and administrative expenses, may be

materially different than was initially recorded. The

Company’s experience and extensive data

accumulated historically indicates that these

estimates have proven reliable over time.

7